UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| | |

| Everi Holdings Inc. |

| (Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| | | | | | | | |

| x | No fee required |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

To Our Stockholders:

| | | | | |

Everi’s results in 2020 reflect one of the most unusual and challenging years in the history of the Company. We faced significant challenges due to the ongoing impact of the coronavirus disease 2019 (“COVID-19”) pandemic. We acted swiftly and focused on addressing the pandemic’s impact on our employees and their families, our Company, and our customers. As a result, we evaluated our business strategies in the second quarter of 2020, and implemented measures to create a safe workplace environment, including implementing remote working policies, reducing our ongoing operating costs, seeking ways to operate our business more efficiently and effectively, and conserving our resources. We also borrowed an additional $125 million, which together with cash on hand and our revolving credit line, provided liquidity.

During the last three years, the world has changed dramatically and so has our business. We are more nimble than ever; and our organization is better able to pivot and adapt to opportunities and challenges as they arise to deliver positive performance.

While much has changed about our business practices, some things have not changed - our focus on the importance of our employees and our strong corporate culture. We also continue to successfully invest to drive future growth; by focusing on developing engaging gaming content for both our land-based and digital gaming operators, and improving the gaming experience and customer efficiencies through our FinTech products and services. Our continued investments in both internal product development and strategic acquisitions are important factors in our ongoing ability to compete better and drive future profitable growth to build long-term shareholder value.

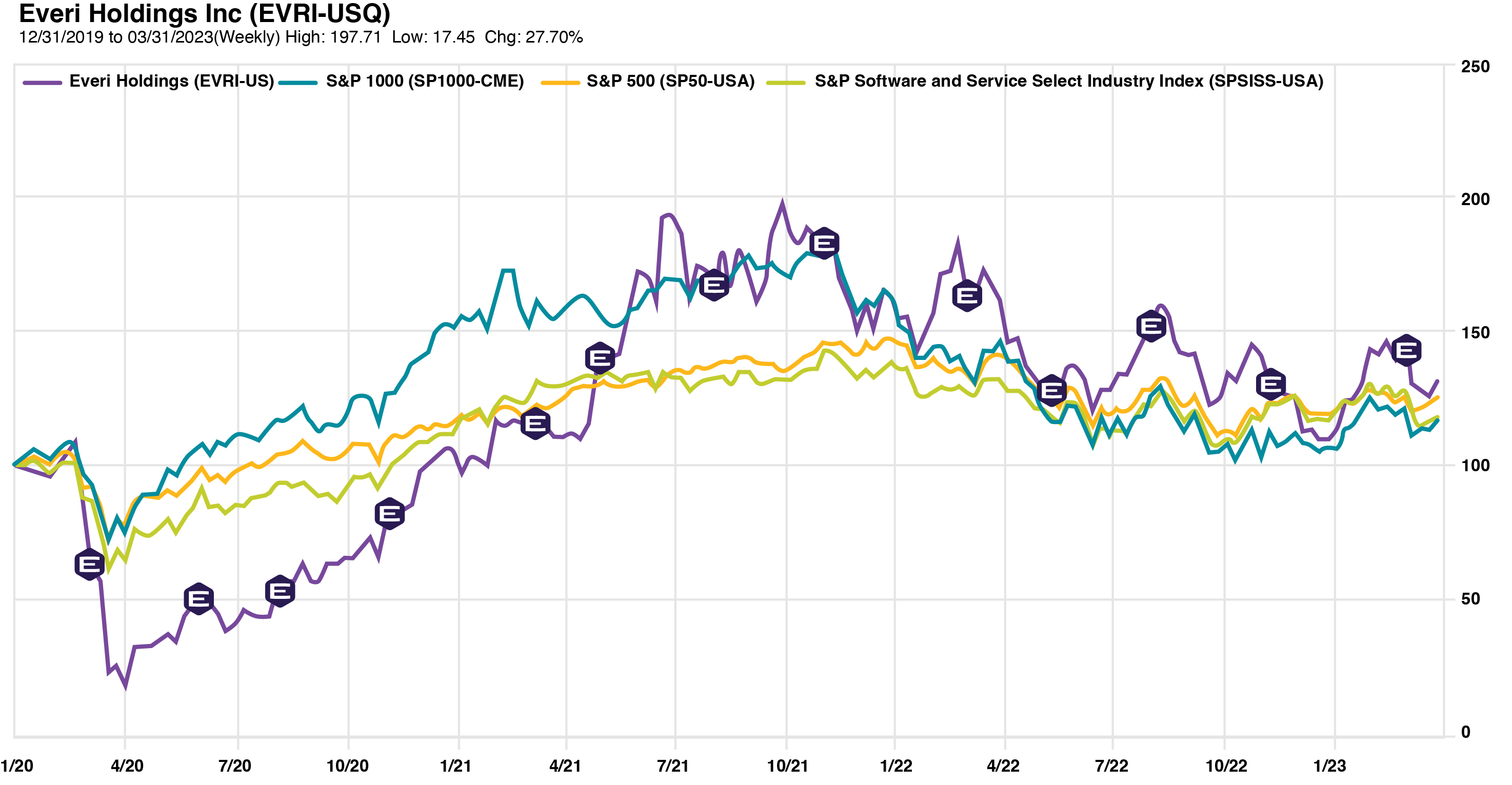

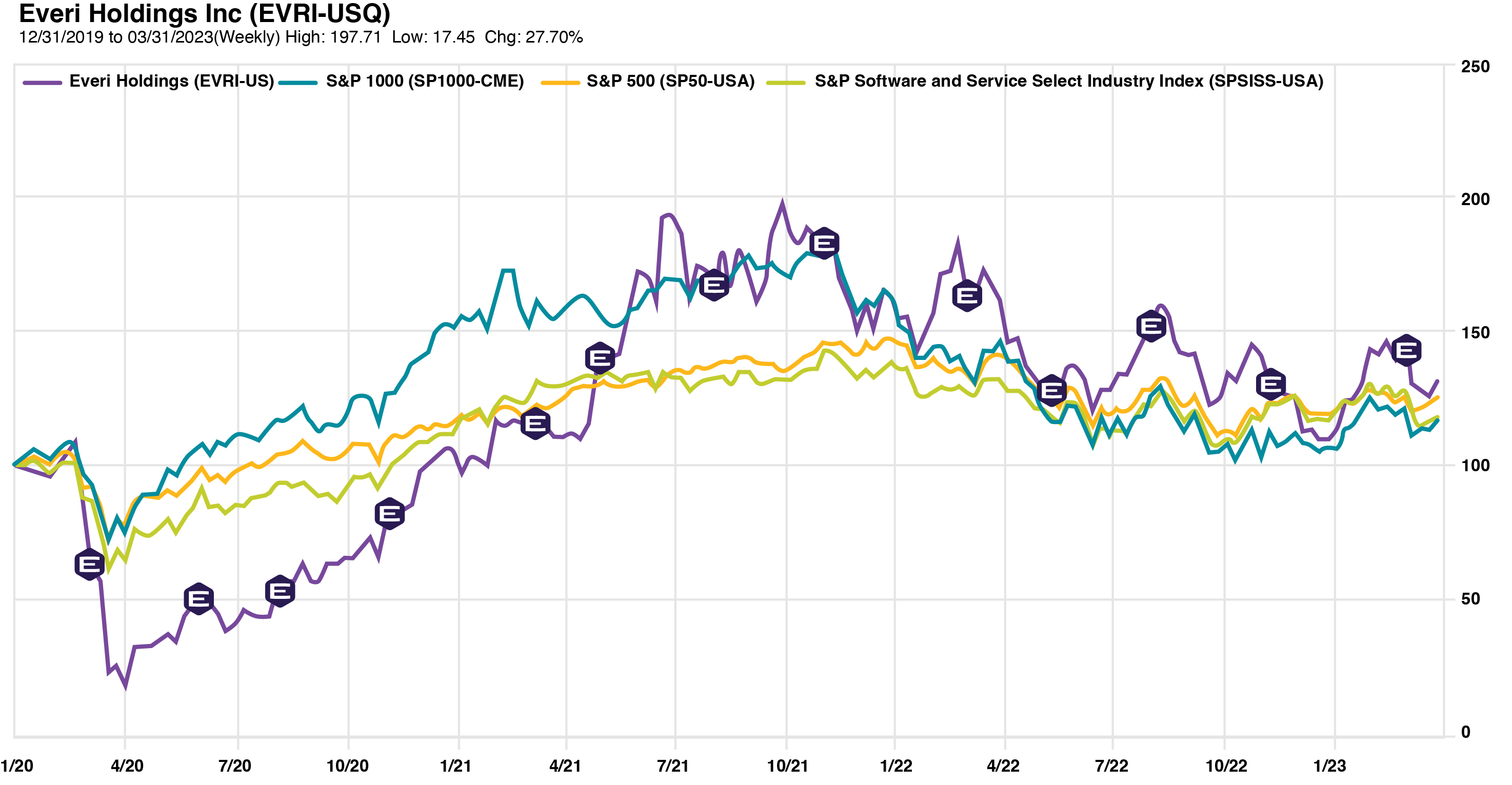

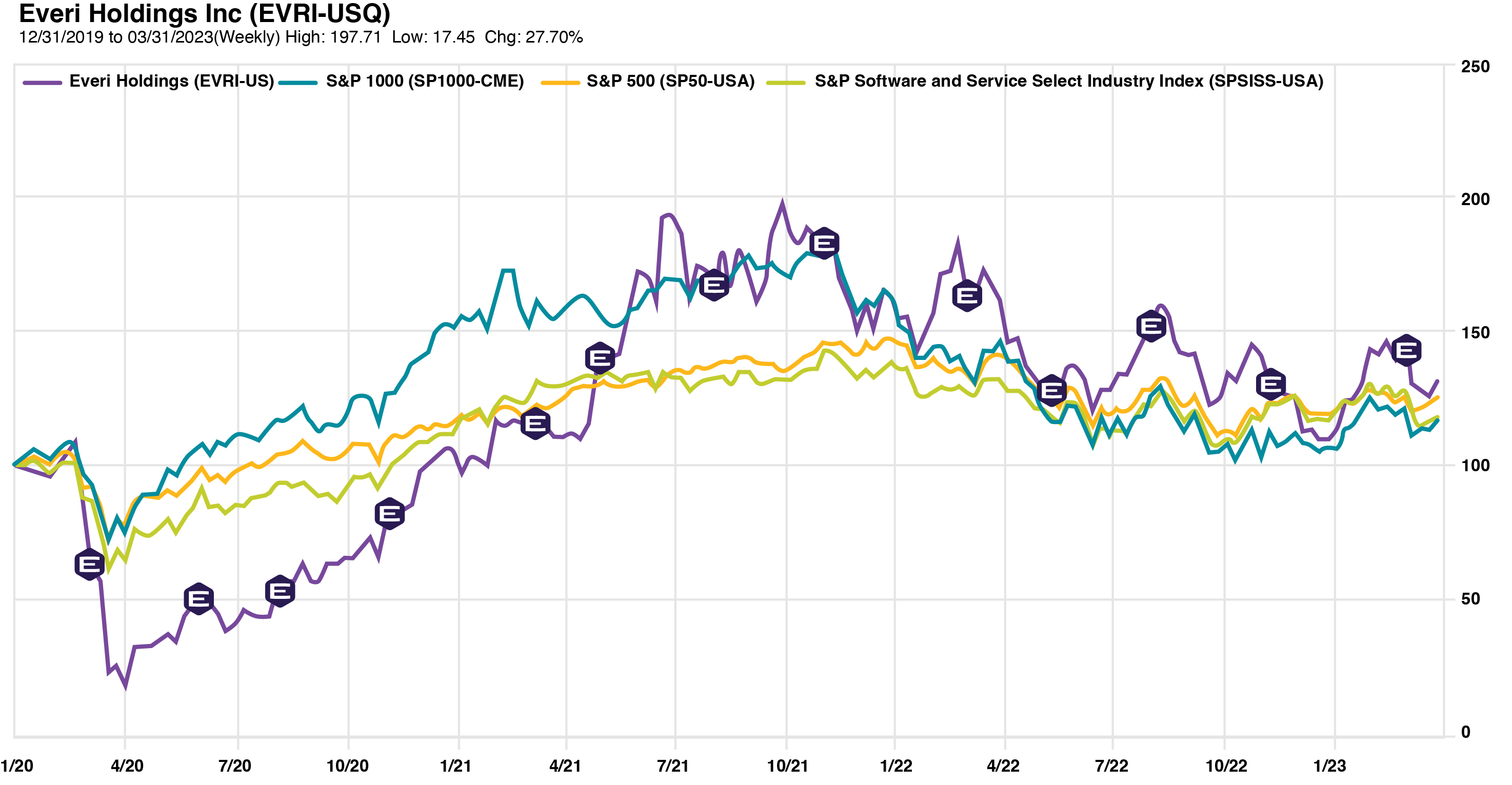

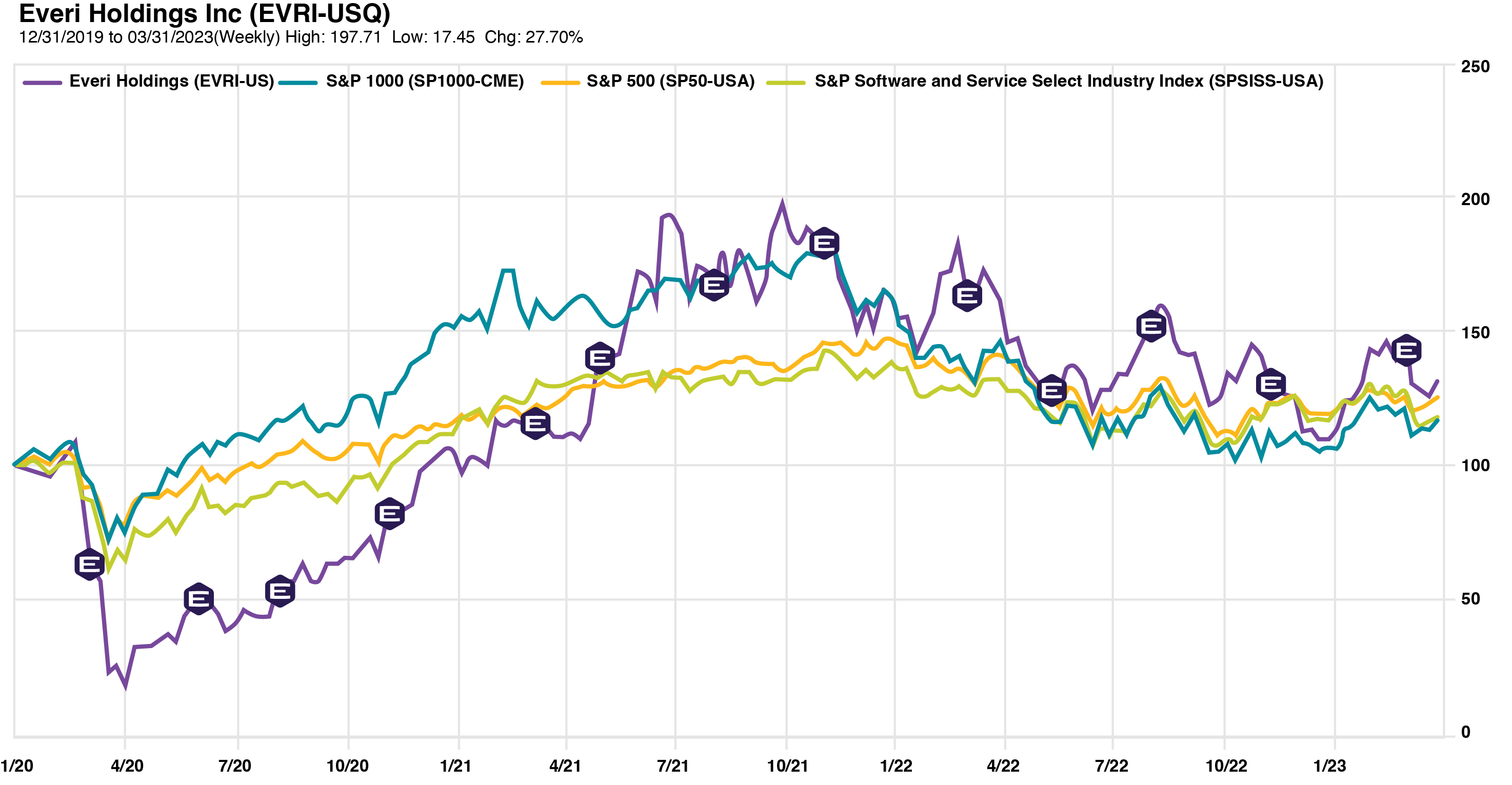

Our momentum continued in 2022 with revenues growing 18% to $783 million, driven by 15% organic growth and a 3% contribution from recent tuck-in acquisitions. Operating income increased 8% to $213 million, while net income declined 22% to $120 million from $153 million in 2021. The decline in net income is principally due to a one-time, $63 million non-cash tax benefit in the prior year related to the reversal of a valuation allowance on certain deferred tax assets. Our Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization(1) increased 8% to $374 million from the prior year.

Importantly, we generated an all-time record $187 million in Free Cash Flow(1) that equated to just over $1.90 per diluted share. We remained disciplined in our deployment of capital to grow the business, with $61 million invested in expenses for internal research and development (“R&D”) and $51 million for acquisitions, while also returning $84 million to shareholders through the repurchase of five million shares under our share repurchase program authorized by our Board in May 2022.

Our ongoing investment in new product development and acquisitions that help grow our product portfolio and addressable markets is a key driver of the operating success in both our Games and FinTech segments. Recent acquisitions, including Intuicode, ecash Holdings and the strategic assets of Venuetize, began to contribute in 2022, and are expected to provide more meaningful contributions to our growth this year, with further benefits in 2024 and beyond.

The opening of the new Sky River Casino in Northern California during 2022 is an excellent example of how we are increasingly leveraging and cross-selling our Gaming and FinTech products and services. At Sky River, we received a nearly 15% allocation of the slot floor, and sold a comprehensive suite of financial access, loyalty and rewards, mobile and regulatory compliance products and services. Sky River Casino has been so successful, they are already making plans for expansion; and we’re proud to be a part of their exciting success story.

Segment highlights

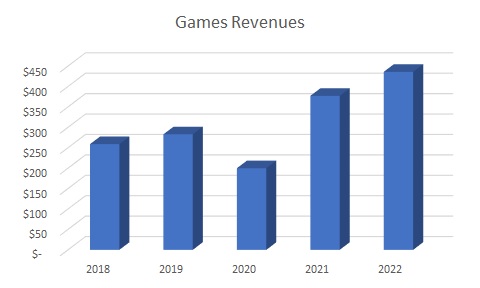

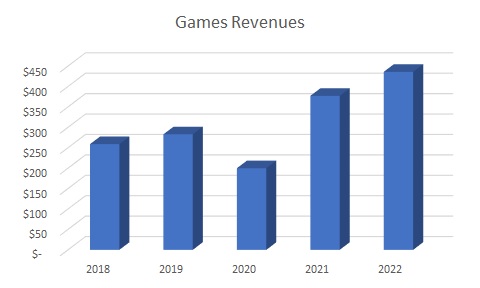

Gaming In 2022, our Games business generated a record $436 million in revenues, a 16% increase over the prior year. We sold a record 7,216 units and our installed base of gaming machines reached a record 17,975 units at year-end. The success of our games and rapid growth in iGaming drove the strong revenue performance, which led to a 5% increase in the segment’s operating income, even as we increased our investments to support future growth by increasing R&D expense to 9% of Games revenues.

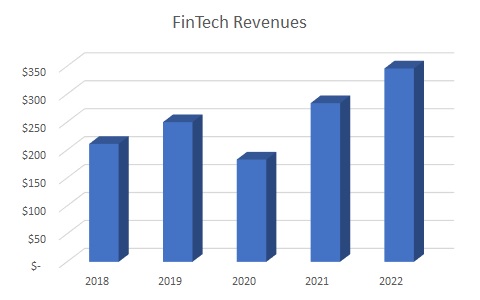

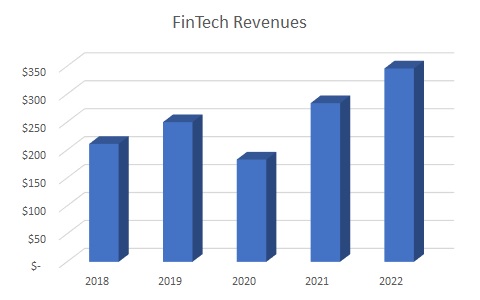

FinTech Our FinTech segment generated record revenues of $346 million, a 22% increase over 2021. Organic growth was 17% and acquisitions contributed 5% to the 2022 revenues. Total financial funding transactions processed increased 5%, while the dollar value of total transactions processed increased by 14%. We continued to leverage strength in our core financial access services and build on our digital capabilities to provide enhanced loyalty and regulatory compliance products and services, which generated higher growth in our software and hardware product revenues. Our revenue strength led to an 11% increase in the segment’s operating income. As with Games, we also increased our focus on internal product development, with R&D expense increasing 55% year over year.

As we continue to navigate the ongoing effects of the COVID-19 pandemic, our first priority continues to be the health and welfare of our employees, our customers, and their guests while maintaining our focus on the long-term success and health of our Company.

The quarterly sequential increases in revenues and net income achieved in the fourth quarter reflect the strength and balance of our businesses, in particular, our significant percentage of higher-margin recurring revenues, and our track record of consistent operating execution. Year-over-year progress in several of our operating metrics, despite increased restrictions on certain casino activities during the quarter, is a direct result of the material advances in our Games and FinTech product portfolios.

These advances reflect our focus on developing new and enhanced products to help our customers extend their relationship with their guests and operate more efficiently, and for which we are seeing increasing demand. Our improved operating performance, together with the ongoing benefits of our cost savings initiatives, resulted in an increase in operating income and our return to generating net income in the fourth quarter.

We believe our FinTech contactless, compliance, and player-loyalty solutions continue to be mission critical elements for our customers as they conduct business. Products and services, such as our digital mobile CashClub Wallet®, and player-loyalty promotional and self-service enrollment kiosks, enable our customers to provide cashless/contactless solutions and operate more cost efficiently, even as they help drive revenue.

Our Games development teams continue to create original, entertaining, in-demand games that provide memorable player experiences for players in both land-based and online digital gaming.

| 2020 Financial Highlights

Revenues

increased on a quarterly sequential basis in each of the third and fourth quarters of 2020

Returned to net income in the fourth quarter

2020 Product Highlights

Annual Gaming and Technology Awards from Global Gaming Business:

Best Slot Product and Best Consumer-Service Technology Awards for Second Consecutive Year

The Vault® game theme won Gold Medal for Best Slot Product

CashClub Wallet® Core Edition technology

won Silver Medal for Best Consumer-Service Technology

|

| | | | | |

Our success in implementing our new product development priorities enabled us to drive improvements in several key performance metrics and execute on new opportunities, such as the demand for cashless funding solutions, despite the challenges of the COVID-19 pandemic. This success, combined with our focus on optimizing our operations, has enabled Everi to address the industry’s current challenges, while positioning us to grow as the operating environment normalizes.

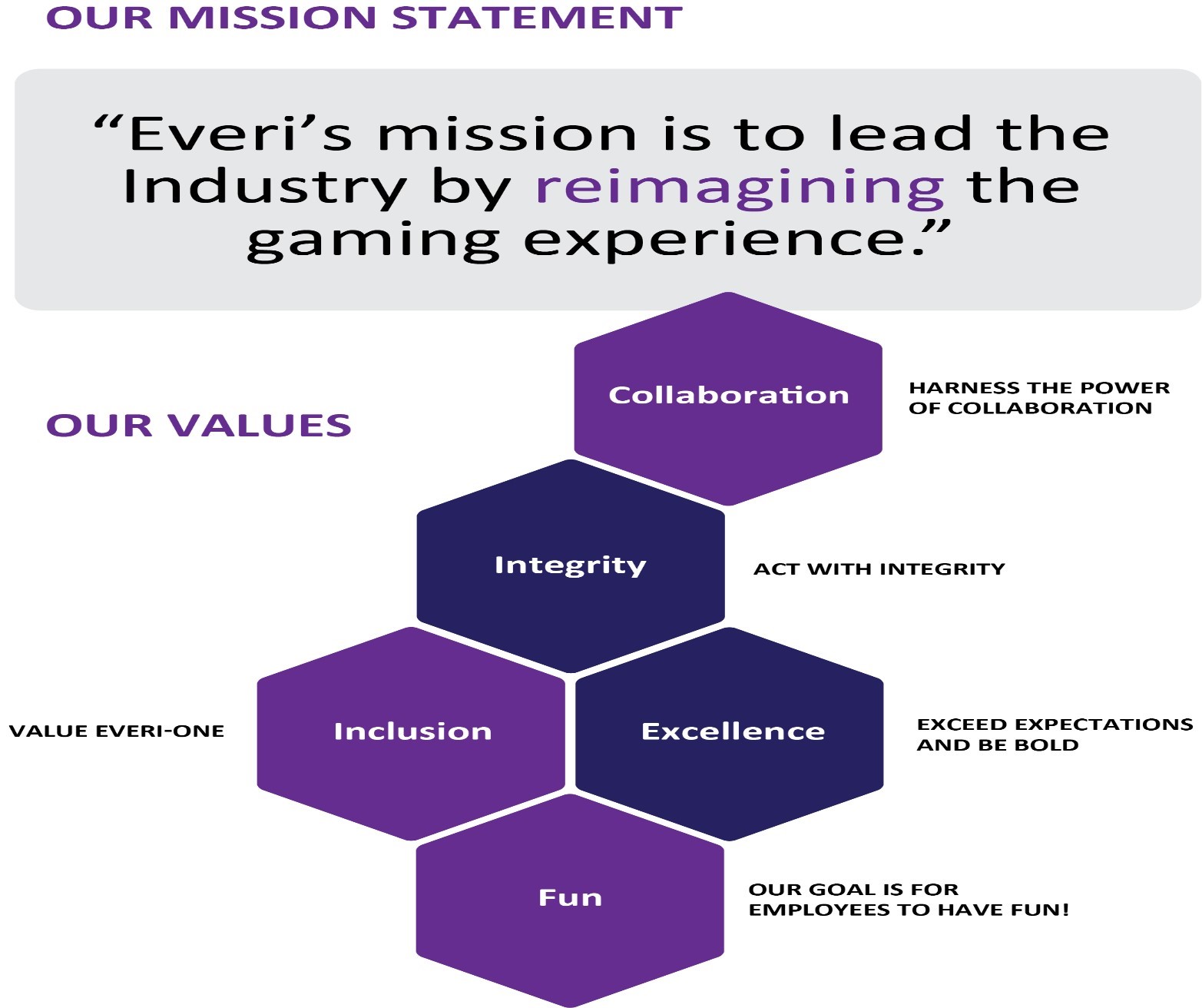

The combination of our core values – Collaboration, Integrity, Inclusion, Excellence, and Fun, our operating initiatives, and long-term growth prospects has provided Everi with a solid foundation on which we can achieve further success. We expect these factors and our focus on fiscal discipline to drive consistent profitable growth and cash flow in the years ahead, as the gaming industry and broader economy recover. Everi is committed to expanding its innovative and creative reach and continuing to build a culture based on the tenets of respect and transparency.

In closing, we would like to thank each and every one of our team members around the globe for their wholehearted commitment during 2020 and their ongoing dedication, as well as for the support of our customers, stockholders, and vendor partners. We have an exciting growth story and look forward to further elevating Everi as a leading supplier of imaginative gaming entertainment content and products and trusted financial technology and loyalty solutions.

On behalf of the Board and employees of Everi, we also thank Miles Kilburn for his 15 years of distinguished service as both a member and Chairman of the Board of Directors. Miles has been an integral contributor to our success and upon his retirement from the Board at the 2021 Annual Meeting, we wish him all the best in his next and future endeavors.

| |

Industry outlook – resilience of the industry and ability to pivot from position of strength

While the general macro environment remains uncertain in the near-term, we believe we remain well positioned to take advantage of new opportunities. Our high percentage of recurring revenues, a strong balance sheet, and strong Free Cash Flow generation provide us with a solid foundation to maintain growth. We have a robust new product pipeline, both in Games and FinTech, and we believe there are opportunities to make additional additive tuck-in acquisitions that would provide a successful and profitable return on our investment and contribute to our long-term revenue and cash flow growth.

Future growth driven by new product development and acquisitions

Looking ahead, in 2023 we expect to continue to concentrate on our growth priorities through our disciplined approach to R&D and investing in future attractive acquisitions.

In our Games business, we are excited about our new product line, including more than 80 new game themes planned for launch in 2023. Further, our new Dynasty VUE™ video gaming cabinet, which began shipping this year complements our existing cabinet line-up and provides customers with new optionality to expand and diversify their footprint of Everi products. Dynasty VUE is just the first cabinet in our next generation line-up with additional models scheduled to debut at G2E™ later this year.

The acquisition of Intuicode has accelerated our growth opportunity in the Historical Horse Racing (“HHR”) market. Toward the end of this year, we plan to further leverage our strength in Class II and Class III games with entry into the Video Lottery Terminals (“VLT”) market. Our new cabinets and the work by our development teams will enable us to create original, engaging content across Class II, Class III, HHR, and Central Determinant markets; and our extensive game pipeline will also support our rapidly growing digital iGaming business. While no new states are expected to legalize iGaming in the near term, we expect to continue to add additional iGaming operator sites and further expand our iGaming themes portfolio, with the potential to enter the larger and more mature U.K. iGaming market toward the end of this year.

In our FinTech business, we will continue our strategy of expanding our digital neighborhood, with new and enhanced products aimed at improving casino operator efficiency and productivity, and which will complement our previous introductions of JackpotXpressTM, PitXpressTM, and MetersXpressTM. The acquisition of assets of Venuetize in 2022, with its broad base of nearly 200 established third-party app integrations, is expected to complement our existing mobile-first development efforts with casino customers, while also providing new avenues for growth by expanding our addressable market through connection of our mobile wallet and loyalty technologies into adjacent markets including sports, entertainment and hospitality venues.

Corporate culture, employee wellness, and new environmental sustainability efforts (“ESG”)

At Everi, we believe that a key driver to our ongoing success is our ability to attract and retain talent. Our positive company culture is valued by our team members and has resulted in Everi receiving 16 Top Workplace honors since 2021. We were honored to be recognized again in 2022 for our efforts to build a diverse and inclusive culture across our domestic and international operations, including recognition for our remote employee programs.

A team-first collaborative culture, and a diverse, respectful work environment with a focus on innovation and operational excellence is important for our long-term success. Inclusion is a core Company value and we believe we can be at our best only when we embrace and reflect the diversity of our employees, customers, and the communities that we serve.

We recently announced the construction of a new leased build-to-suit production and warehouse facility in Las Vegas, which will consolidate the assembly of our slot machines and Fintech kiosks and other products into one streamlined operation. This state-of-the-art facility is being built to be environmentally friendly with an emphasis on long-term environmental sustainability and employee wellness.

Governance – strong focus, changes

In 2022, we implemented our succession plan with our now former Chief Executive Officer, Michael Rumbolz, moving into the new position of Executive Chair of the Board, and Randy Taylor succeeding Mike as Chief Executive Officer. Atul Bali was named Lead Independent Director succeeding Ron Congemi who retired after nearly nine years on our Board. Additionally, Eileen Raney retired from our Board after serving six years. We thank Ron and Eileen for their many years of distinguished service. In addition to Randy joining our Board following his promotion, Secil Tabli Watson, Paul Finch, and Debra Nutton joined our Board, each of whom provides extensive business leadership as well as work experience diversity to our board.

Conclusion

In closing, we want to thank our team members for all they do each day to bring innovation and to drive our growth and success. We also want to thank our customers and vendor partners, and to you our shareholders for your continued support. We are excited for the future ahead.

/s/ Randy L. Taylor /s/ Michael D. Rumbolz

Randy L. Taylor Michael D. Rumbolz

President and Chief Executive Officer Executive Chair of the Board

April 21, 2023

April 19, 2021

April 19, 202121, 2023

Dear Stockholder:

On behalf of the Board of Directors and officers of Everi Holdings Inc. (“we,” “us,” “our,” “Everi,” or the “Company”), we are pleased to invite you to attend our 20212023 Annual Meeting of Stockholders. The meeting will be held at Everi’s headquarters located at 7250 S.South Tenaya Way, Suite 100, Las Vegas, Nevada 89113, on Wednesday, May 19, 202117, 2023 at 9:00 a.m. Pacific Time (the “Annual Meeting”).

Due to the ongoing public health impact of the coronavirus disease 2019 (“COVID-19”) global pandemic, and in consideration of the health and well-being of our stockholders and other meeting participants, we will require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention, including the wearing of masks and maintaining social distancing.

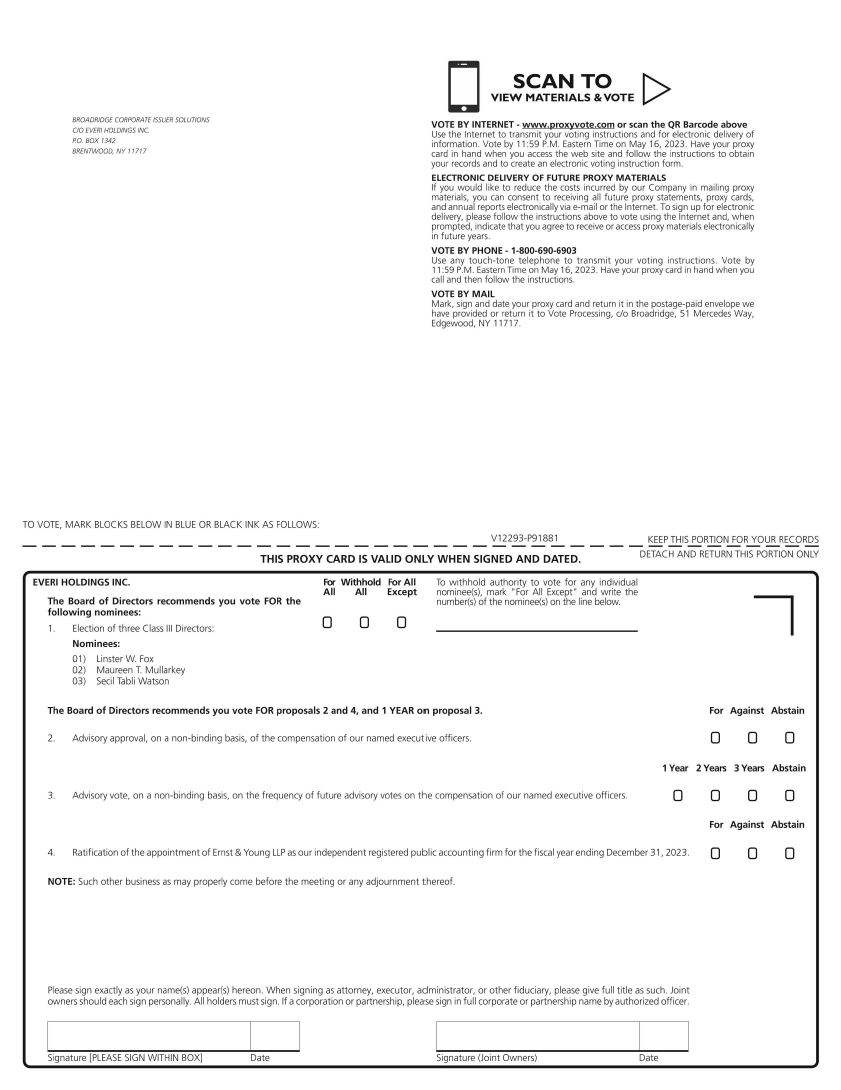

At the Annual Meeting, you will be asked to:

| | 1 | 1 | | 2 | | 3 | | 4 | | 5 | 1 | | 2 | | 3 | | 4 | | 5 |

| Elect two Class I director nominees named in this Proxy Statement. | | Approve, on a non-binding, advisory basis, the compensation of our named executive officers. | | Approve the Everi Holdings Inc. Amended and Restated 2014 Equity Incentive Plan. | | Ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. | | Transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. | |

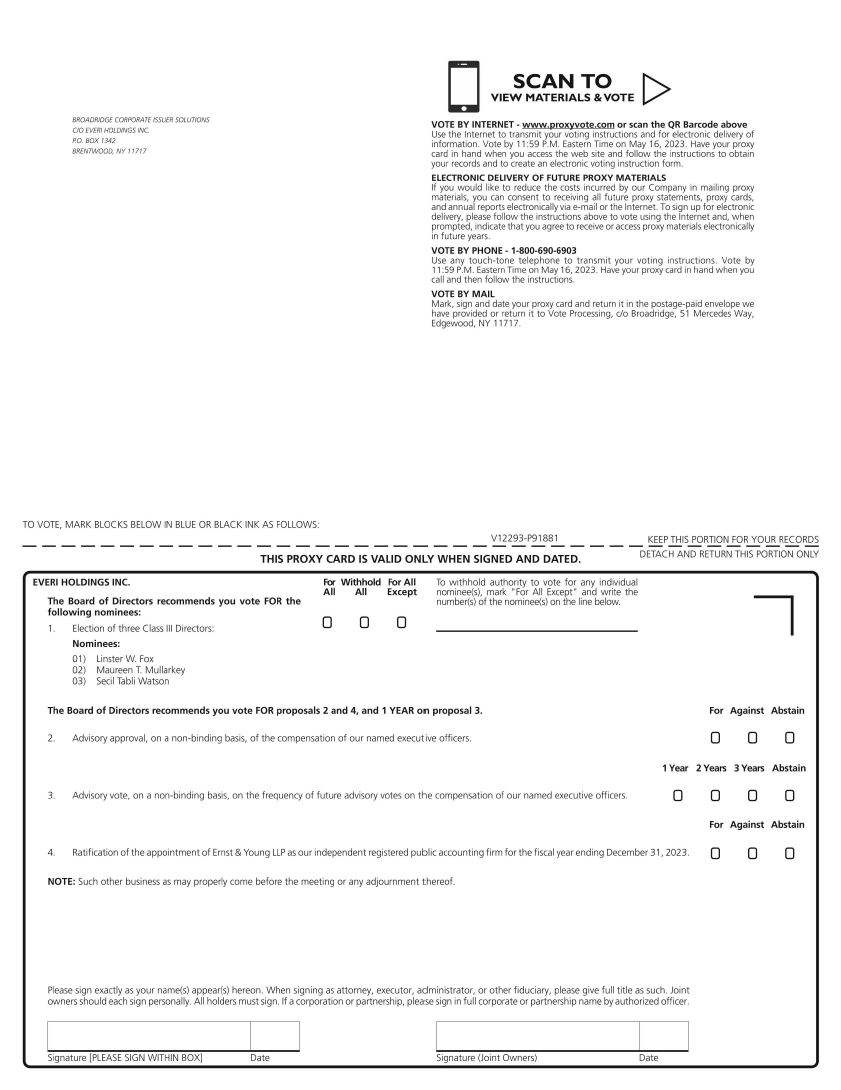

| Elect three Class III director nominees named in this Proxy Statement. | | Elect three Class III director nominees named in this Proxy Statement. | | Approve, on a non-binding, advisory basis, the compensation of our named executive officers. | | Vote on a non-binding, advisory basis on the frequency of future advisory votes on the compensation of our named executive officers. | | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | | Transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The accompanying Proxy Statement provides a detailed description of these proposals and other information that you should read and consider before voting.

Your vote is very important to us. Regardless of whether you expect to attend the Annual Meeting in person, please submit your proxy or voting instructions over the Internet, telephone, or by mail as soon as possible to ensureso that your shares are represented at the Annual Meeting and your vote is properly recorded. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you previously submitted your proxy.

If you have any questions concerning the Annual Meeting, and you are the stockholder of record of your shares, please contact our Senior Vice President, Investor Relations, William Pfund, at william.pfund@everi.com or (702) 676-9513. If your shares are held by a broker or other nominee, please contact your broker or other nominee for questions concerning the Annual Meeting.

We are fully cognizant of the continued challenges for the Company, our people, our customers, our stockholders, and our other stakeholders. During these uncertain times, we remain optimistic that our products and services will remain highly valued by our customers and their patrons. Your Board brings executive, financial, and strategic leadership together with a wide range of complementary skills and backgrounds relative to the Company’s industry, to assist management in navigating these uncharted times.continuing to drive success. The Board remains diligent and highly focused on our people, sustainable growth, and performance as we continue to build long-term shareholder value and continue striving for a more diverse and inclusive Company. On behalf of the Board of Directors and our employees, we thank you for your past and ongoing support of the Company.

Sincerely,

/s/ Michael D. RumbolzRandy L. Taylor

Michael D. RumbolzRandy L. Taylor

President and Chief Executive Officer & Director

| | | | | |

NOTICE OF 20212023 ANNUAL MEETING OF STOCKHOLDERS |

Date and Time: Wednesday, May 19, 202117, 2023 9:00 a.m. Pacific Time | Location: Everi Holdings Inc. Corporate Headquarters 7250 S.South Tenaya Way, Suite 100 Las Vegas, Nevada 89113 |

To Our Stockholders:

You are cordially invited to attend the 20212023 Annual Meeting of Stockholders (the “Annual Meeting”) of Everi Holdings Inc., at which stockholders will vote on the following proposals listed below. Your vote is very important to us. Regardless of whether you expect to attend the Annual Meeting in person, please submit your proxy or voting instructions over the Internet, telephone, or by mail as soon as possible to ensureso that your shares are represented at the Annual Meeting and your vote is properly recorded. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you previously submitted your proxy. The Company may require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention, which may include recommended social distancing and the use of personal protective equipment such as face masks.

| | | | | | | | | | | |

Voting Matters | | |

| Proposals | | How to Vote |

| 1. | Election of twothree Class IIII director nominees named in this Proxy Statement. | | | Visit www.proxyvote.com. You will need or the 16-digit number included inwebsite on your proxy card or voting instruction form. |

| 2. | To approve on a non-binding, advisory basis, the compensation of our named executive officers. | | | Call 1-800-690-6903 or the number on your voting instruction form. You will need the 16-digit number included in your proxy card or voting instruction form. |

3.3 | To approvevote on a non-binding, advisory basis on the Everi Holdings Inc. Amended and Restated 2014 Equity Incentive Plan to, among other things, increasefrequency of future advisory votes on the maximum aggregate numbercompensation of shares that may be issued thereunder by 5,000,000 shares.our named executive officers. | | | Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form. |

4.4 | To ratify the appointment of BDO USA,Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2023. | | | If you plan to attend the meeting in person, you will need to bring a government-issued picture ID and proof of ownership of Everi Holdings Inc. common stock as of the record date. The Company may require attendees to comply with health and safety protocols, including social distancing and the use of personal protective equipment such as face masks. |

| 5. | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. | | | |

Given the impact of the COVID-19 pandemic, weWe strongly encourage you to vote in advance of the meeting over the Internet, telephone, or by mail as described above.

| | |

| Record Date |

Stockholders of record as of the close of business on April 5, 20216, 2023 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 19, 2021. 17, 2023. Our Proxy Statement is attached. Financial and other information concerning Everi Holdings Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 20202022 (the “2020“2022 Annual Report”). A complete set of proxy materials relating to our Annual Meeting is available on the Internet. These materials, consisting of the Notice of 20212023 Annual Meeting of Stockholders, Proxy Statement, Proxy Card, and 20202022 Annual Report are available and may be viewed at www.proxyvote.com. |

This Notice of Annual Meeting and the accompanying Proxy Statement are first being made available to our stockholders on or about April 19, 2021.21, 2023.

By Order of the Board of Directors,

/s/ Kate C. Lowenhar-Fisher

Kate C. Lowenhar-Fisher

Executive Vice President, Chief Legal Officer – General Counsel

and Corporate Secretary

April 19, 202121, 2023

| | | | | | | | | | | | | | | | | |

| PROXY STATEMENT TABLE OF CONTENTS |

| PROXY STATEMENT SUMMARY | | | | Severance Benefits | |

| 2022 Performance Highlights | | | | Compensation Committee Report | |

| Corporate Governance Highlights | | | | Members of the Compensation Committee | |

| Environmental, Social, and Governance | | | | Compensation of Named Executive Officers | |

| PROXY STATEMENT | | | | 2022 Summary Compensation Table | |

| | | | Grants of Plan-Based Awards | |

| | Outstanding Equity Awards | |

| BOARD AND CORPORATE GOVERNANCE MATTERS | | | | 2022 Option Exercises and Stock Vested | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | | Employment Contracts and Equity Agreements, Termination of Employment, and Change in Control Arrangements | |

| EXECUTIVE OFFICERS | | | |

| | | | Pension Benefits and Nonqualified Deferred Compensation | |

| |

| | | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| |

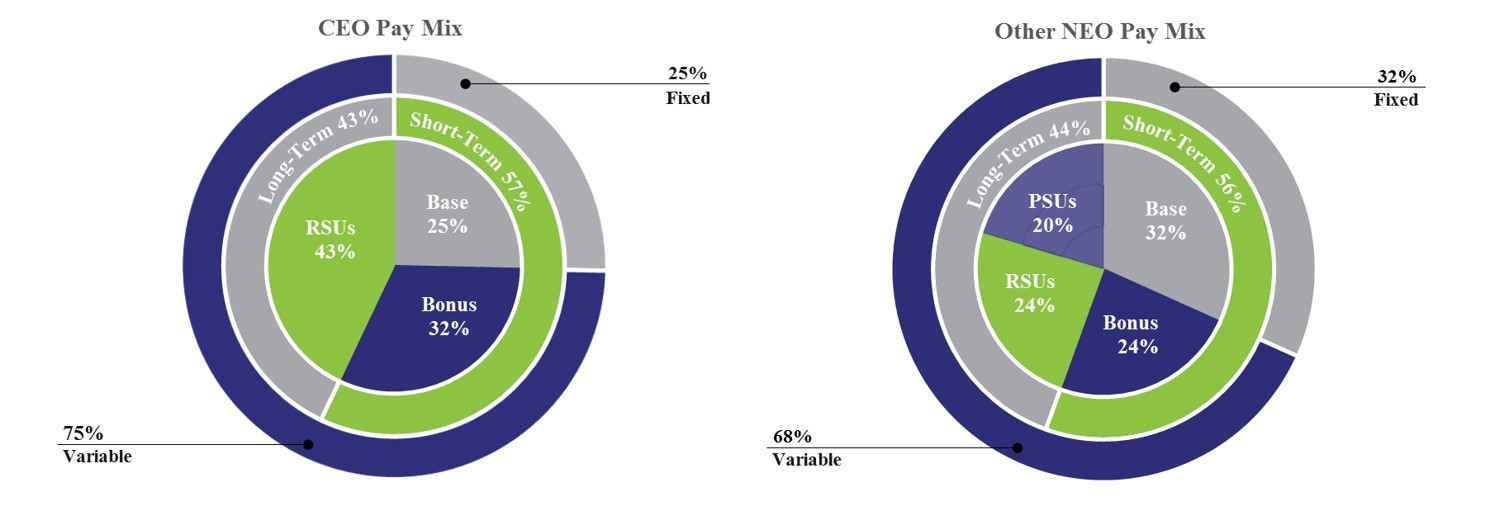

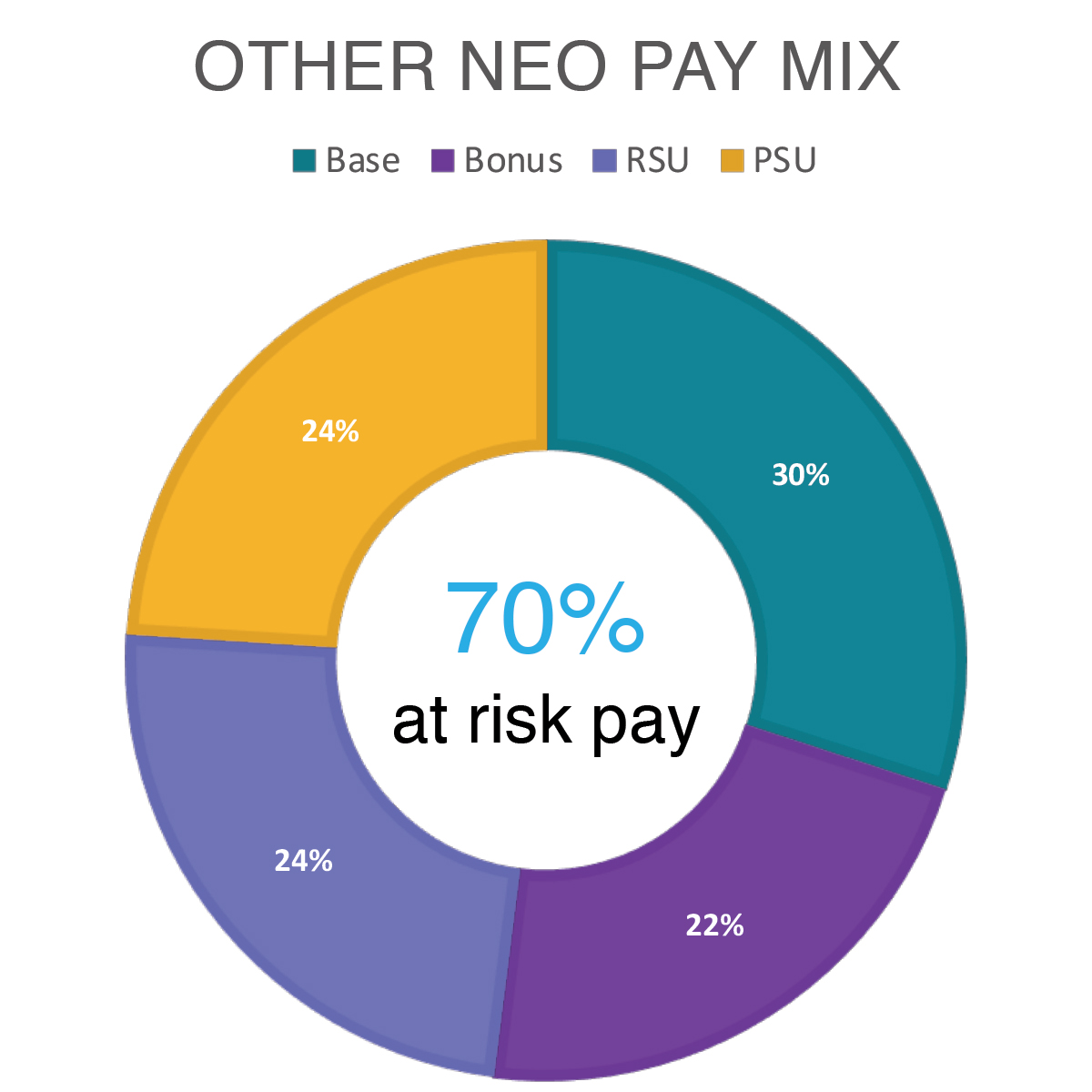

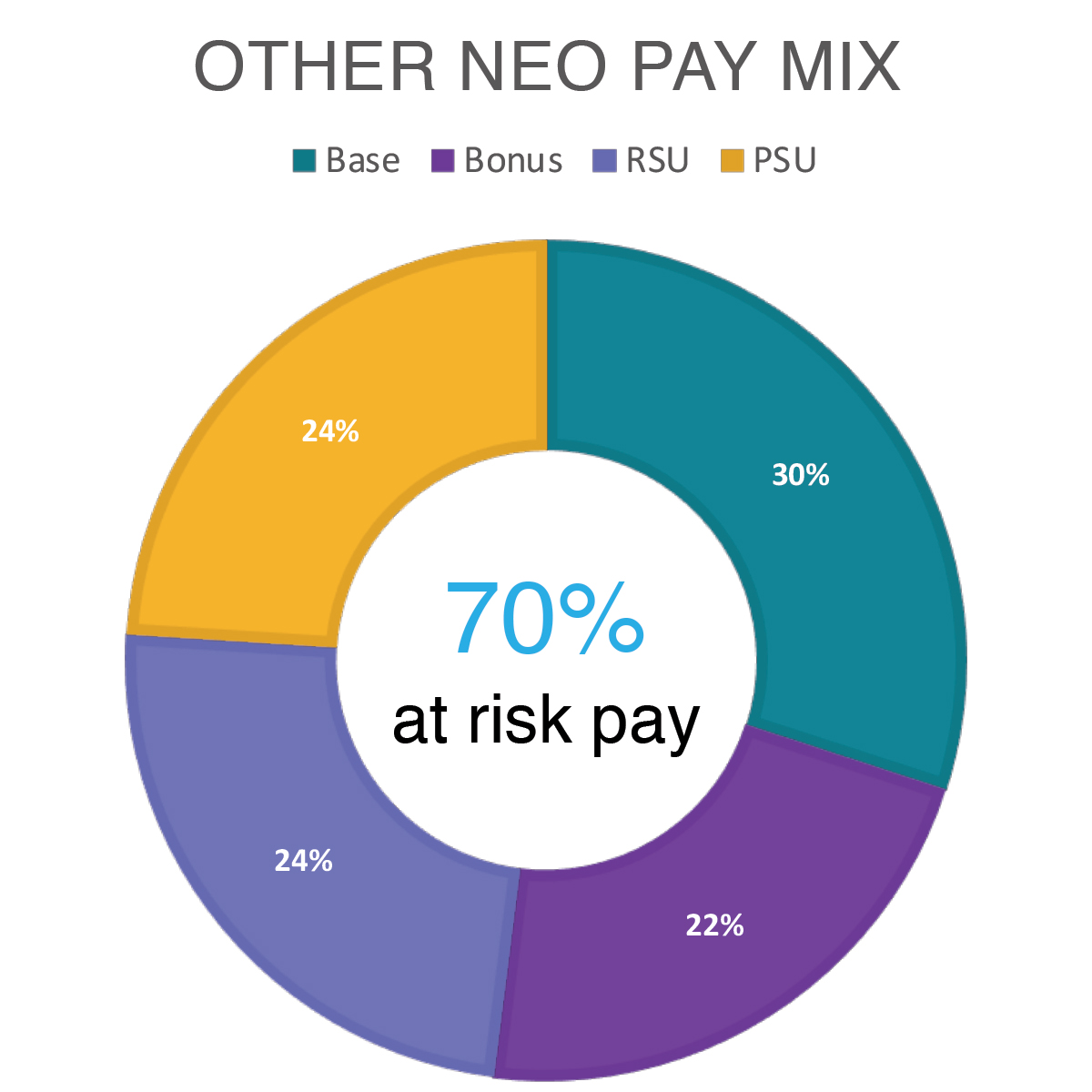

| EXECUTIVE COMPENSATION | | | | | |

| Compensation Discussion and Analysis | | | | EQUITY COMPENSATION PLAN INFORMATION | |

| I. EXECUTIVE SUMMARY | | | | PAY RATIO | |

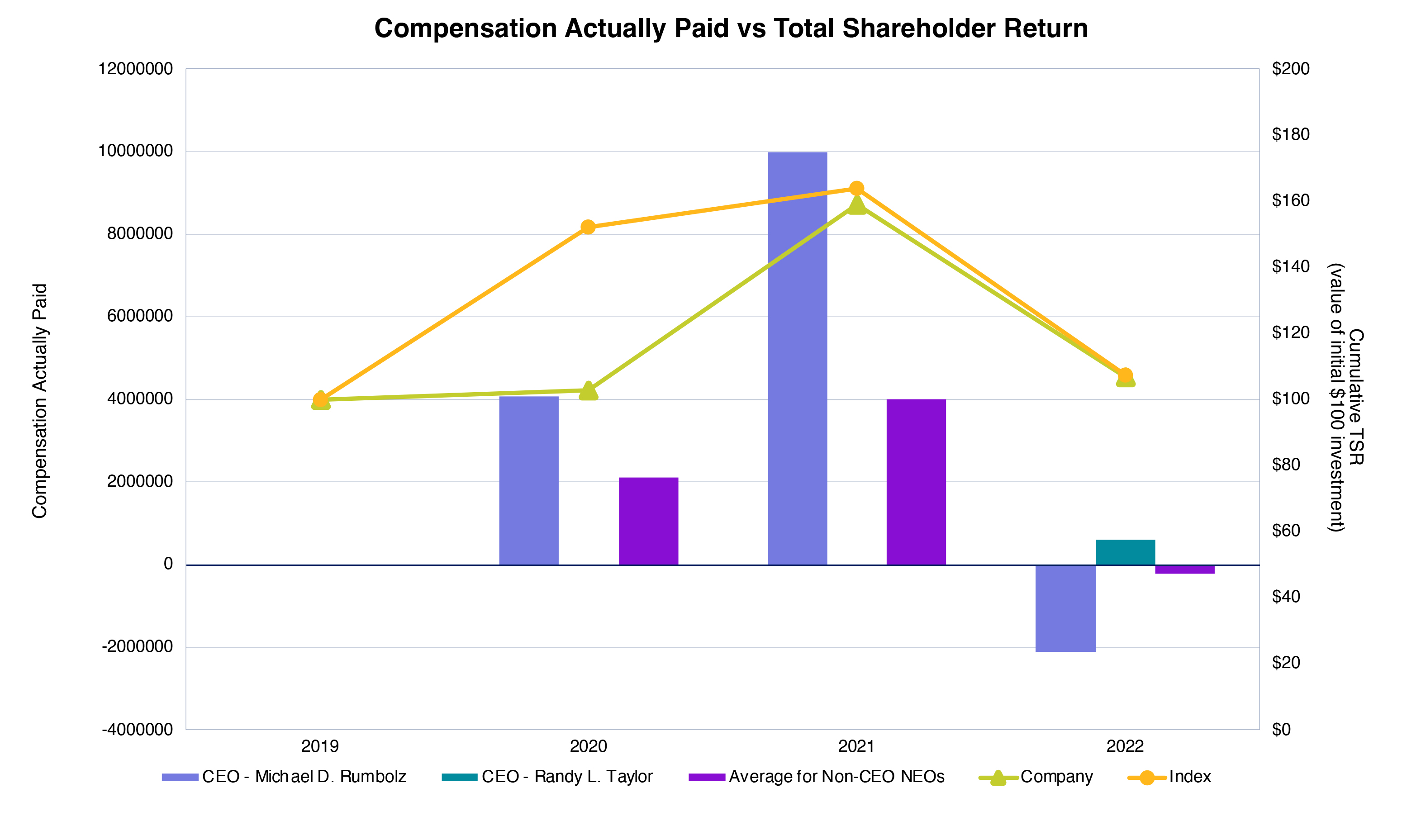

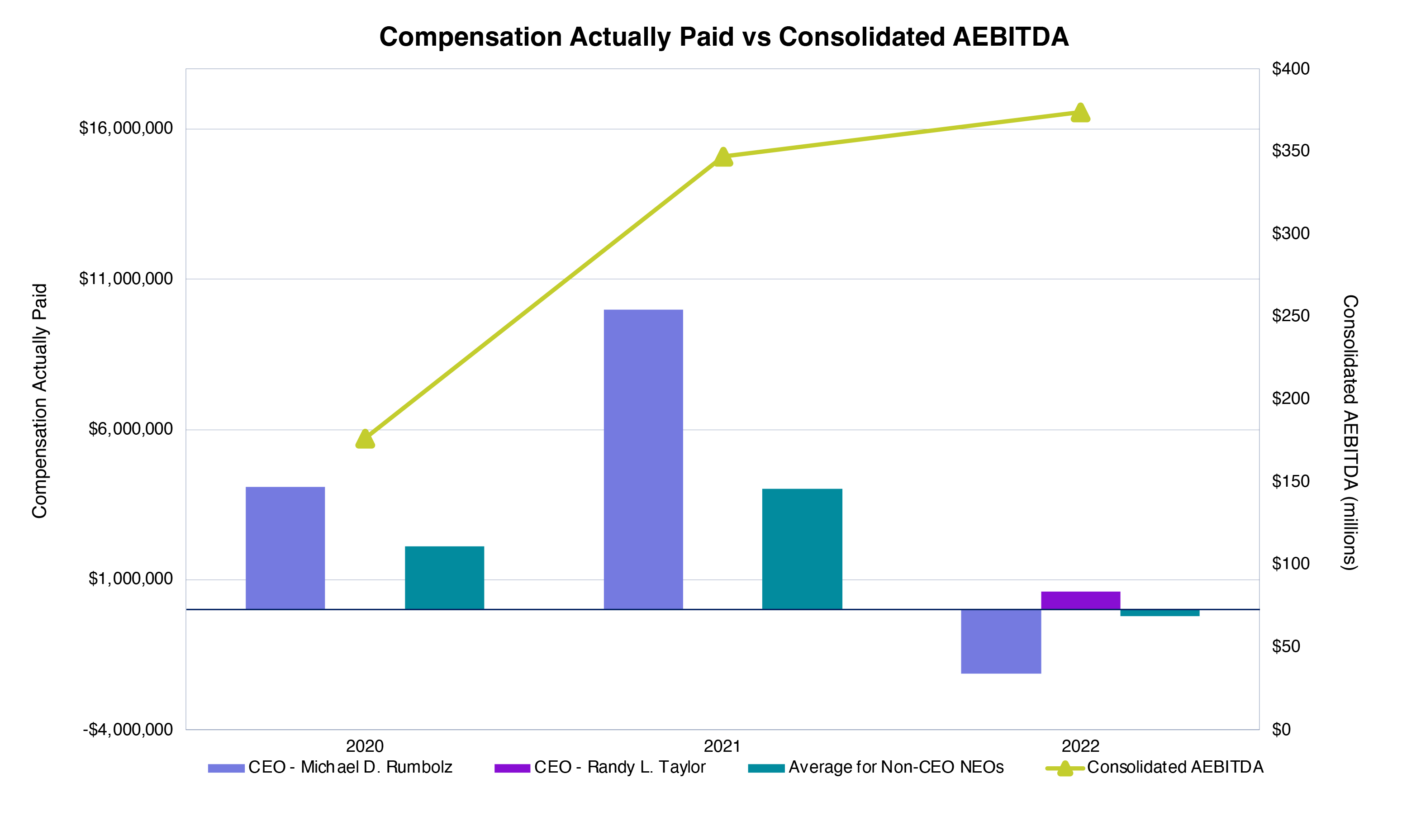

| Management Transition | | | | PAY VERSUS PERFORMANCE | |

| Compensation Actions | | | | | |

| II. COMPENSATION PHILOSOPHY AND OBJECTIVES | | | | | |

| Compensation Governance Practices | | | |

| Components of Our Compensation Program | | | | REPORT OF THE AUDIT COMMITTEE | |

| 2022 Target Total Compensation | | | | FREQUENTLY ASKED QUESTIONS | |

| 2022 Say on Pay Results | | | | DELINQUENT SECTION 16(a) REPORTS | |

| III. COMPENSATION DECISION MAKING PROCESS | | | | OTHER MATTERS | |

| Role of the Board | | | | ANNUAL REPORT TO STOCKHOLDERS AND ANNUAL REPORT ON FORM 10-K | |

| Role of the Compensation Committee | | | |

| Role of Management | | | | APPENDIX A: UNAUDITED RECONCILIATION OF SELECTED FINANCIAL GAAP TO NON-GAAP MEASURES | |

| Role of Compensation Consultants | | | | APPENDIX B: PROXY VOTING CARD | |

| Compensation Risk Oversight | | | | | |

| IV. COMPENSATION COMPETITIVE ANALYSIS | | | | | |

| Peer Group | | | | | |

| V. ELEMENTS OF COMPENSATION | | | | |

| Base Salary Compensation | | | | | |

| Annual Incentives | | | | | |

| 2022 Annual Incentive Performance Metrics | | | | | |

| 2022 Performance and Actual Payouts | | | | | |

| Long-Term Equity Incentive Awards | | | | | |

| 2022 Annual Equity Awards | | | INDEX OF FREQUENTLY REQUESTED INFORMATION |

| VI. ADDITIONAL COMPENSATION POLICIES AND PRACTICES | | | Corporate Governance Highlights | |

| | | Environmental, Social, and Governance | |

| Equity Ownership Policy | | | Director Nominees | |

| Clawback Policy | | |

| Anti-Hedging and Anti-Pledging Policies | | | Director Compensation | |

| Tax Considerations | | | Compensation of Named Executive Officers | |

| Retirement Plans | | | Pay Ratio | |

| | | | | | | | | | | | | | |

| 2023 Annual Meeting of Stockholders |

| PROXY STATEMENT TABLE OF CONTENTS | | | |

DATE AND TIME Wednesday, May 17, 2023 9:00 a.m. Pacific Time

| |

LOCATION Everi Holdings Inc. Corporate Headquarters 7250 South Tenaya Way, Suite 100 Las Vegas, NV 89113

| |

RECORD DATE APRIL 6, 2023

|

| | | | | | | | | | | |

How to Vote

|

VIA THE INTERNET

Visit www.proxyvote.com or the website on your voting instruction form. | BY TELEPHONE

Call 1-800-690-6903 or the number on your voting instruction form. | BY MAIL

Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form. | ATTENDING THE MEETING

If you plan to attend the meeting in person, you will need to bring a government-issued picture ID and proof of ownership of Everi Holdings Inc. common stock as of the record date. |

| | | | | | | | | | | | | | | | | | | | |

| Annual Meeting Proposals |

| Proposal | | Description | | Board Recommendation | | Page (for more detail) |

| 1 | | Election of three Class III director nominees named in this Proxy Statement. | | þ FOR each of the Board’s nominees | | |

| 2 | | Approval, on a non-binding advisory basis, of the compensation of our named executive officers. | | þ FOR | | |

| 3 | | Vote, on a non-binding, advisory basis, on the frequency of future advisory votes on the compensation of our named executive officers. | | þ EVERY YEAR | | |

| 4 | | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | | þ FOR | | |

| | | | | | | | | | | | | | | | | |

| PROXY STATEMENT SUMMARY | | | | Severance Benefits | |

| 2020 Performance Highlights | | | | Compensation Committee Report | |

| Corporate Governance Highlights | | | | Members of the Compensation Committee | |

| Environmental Sustainability; Social Responsibility | | | | Compensation of Named Executive Officers | |

| PROXY STATEMENT | | | | 2020 Summary Compensation Table | |

PROPOSAL 1: ELECTION OF TWO CLASS I DIRECTORS | | | | Grants of Plan-Based Awards | |

| | Outstanding Equity Awards | |

| BOARD AND CORPORATE GOVERNANCE MATTERS | | | | 2020 Option Exercises and Stock Vested | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | | Employment Contracts and Equity Agreements, Termination of Employment, and Change in Control Arrangements | |

| EXECUTIVE OFFICERS | | | |

PROPOSAL 2: ADVISORY (NON-BINDING) VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (SAY ON PAY) | | | | Pension Benefits and Nonqualified Deferred Compensation | |

| | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| EXECUTIVE COMPENSATION | | | |

| Compensation Discussion and Analysis | | | | EQUITY COMPENSATION PLAN INFORMATION | |

| I. EXECUTIVE SUMMARY | | | | PAY RATIO | |

| Compensation Actions | | | | PROPOSAL 3: APPROVAL OF THE EVERI HOLDINGS INC. AMENDED AND RESTATED 2014 EQUITY INCENTIVE PLAN | |

| II. COMPENSATION PHILOSOPHY AND OBJECTIVES | | | |

| Compensation Governance Practices | | | | PROPOSAL 4: RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| Components of Our Compensation Program | | | |

| 2020 Target Total Compensation | | | | REPORT OF THE AUDIT COMMITTEE | |

| 2020 Say on Pay Results | | | | DELINQUENT SECTION 16(a) REPORTS | |

| III. COMPENSATION DECISION MAKING PROCESS | | | | FREQUENTLY ASKED QUESTIONS | |

| Paying for Performance: Realizable Pay | | | | OTHER MATTERS | |

| Role of the Board | | | | ANNUAL REPORT TO STOCKHOLDERS AND ANNUAL REPORT ON FORM 10-K | |

| Role of the Compensation Committee | | | |

| Role of Management | | | | APPENDIX A: RECONCILIATION OF NON-GAAP MEASURES | |

| Role of Compensation Consultants | | | |

| Compensation Risk Oversight | | | | APPENDIX B: EVERI HOLDINGS INC. AMENDED AND RESTATED 2014 EQUITY INCENTIVE PLAN | |

| IV. COMPENSATION COMPETITIVE ANALYSIS | | | |

| Peer Group | | | | APPENDIX C: SUPPLEMENT TO PRESENT REQUIRED INFORMATION IN SEARCHABLE FORMAT | |

| V. ELEMENTS OF COMPENSATION | | | |

| Base Salary Compensation | | | | | |

| Annual Incentives | | | | |

| 2020 Performance Metrics | | | | | |

| 2020 Performance and Actual Payouts | | | | | |

| Long-Term Equity Incentive Awards | | | INDEX OF FREQUENTLY REQUESTED INFORMATION |

| 2020 Awards | | | Corporate Governance Highlights | |

| VI. ADDITIONAL COMPENSATION POLICIES AND PRACTICES | | | Environmental Sustainability; Social Responsibility | |

|

| Equity Ownership Policy | | | Director Nominees | |

| Clawback Policy | | | Compensation of Directors | |

| Anti-Hedging and Anti-Pledging Policies | | | Compensation of Named Executive Officers | |

| Tax Considerations | | | Pay Ratio | |

| Retirement Plans | | | | | |

| | | | | | | | | | | | | | |

PROXY STATEMENT SUMMARYGeneral |

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Everi Holdings Inc. (“we,” “us,” “Everi”“Everi,” or the “Company”) for use at the 20212023 Annual Meeting of Stockholders and at any adjournment or postponement thereof. On or about April 19, 2021,21, 2023, we will begin distributing to each stockholder entitled to vote at the 20212023 Annual Meeting of Stockholders this Proxy Statement, the Notice of 20212023 Annual Meeting of Stockholders, a proxy card or voting instruction form, and our 20202022 Annual Report. Shares represented by a properly executed proxy will be voted in accordance with the instructions provided by the stockholder. This summary highlights information contained elsewhere in this Proxy Statement; however, it does not contain all of the information you should consider. You should read the entire Proxy Statement before casting your vote.

| | | | | | | | | | | | | | | | | | | | |

| Voting Matters and Board Recommendations |

| Proposal | | Description | | Board Recommendation | | Page (for more detail) |

| 1 | | Election of two Class I director nominees named in this Proxy Statement. | | FOR each of the Board’s nominees | | |

| 2 | | Approval, on an advisory basis, of the compensation of our named executive officers. | | FOR | | |

| 3 | | Approval of the Everi Holdings Inc. Amended and Restated 2014 Equity Incentive Plan. | | FOR | | |

| 4 | | Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. | | FOR | | |

Stockholders will also transact any other business that properly comes before the meeting.

Additional information, including “FREQUENTLY ASKED QUESTIONS” about this Proxy Statement, the Annual Meeting, and voting can be found on page 81.87.

| | |

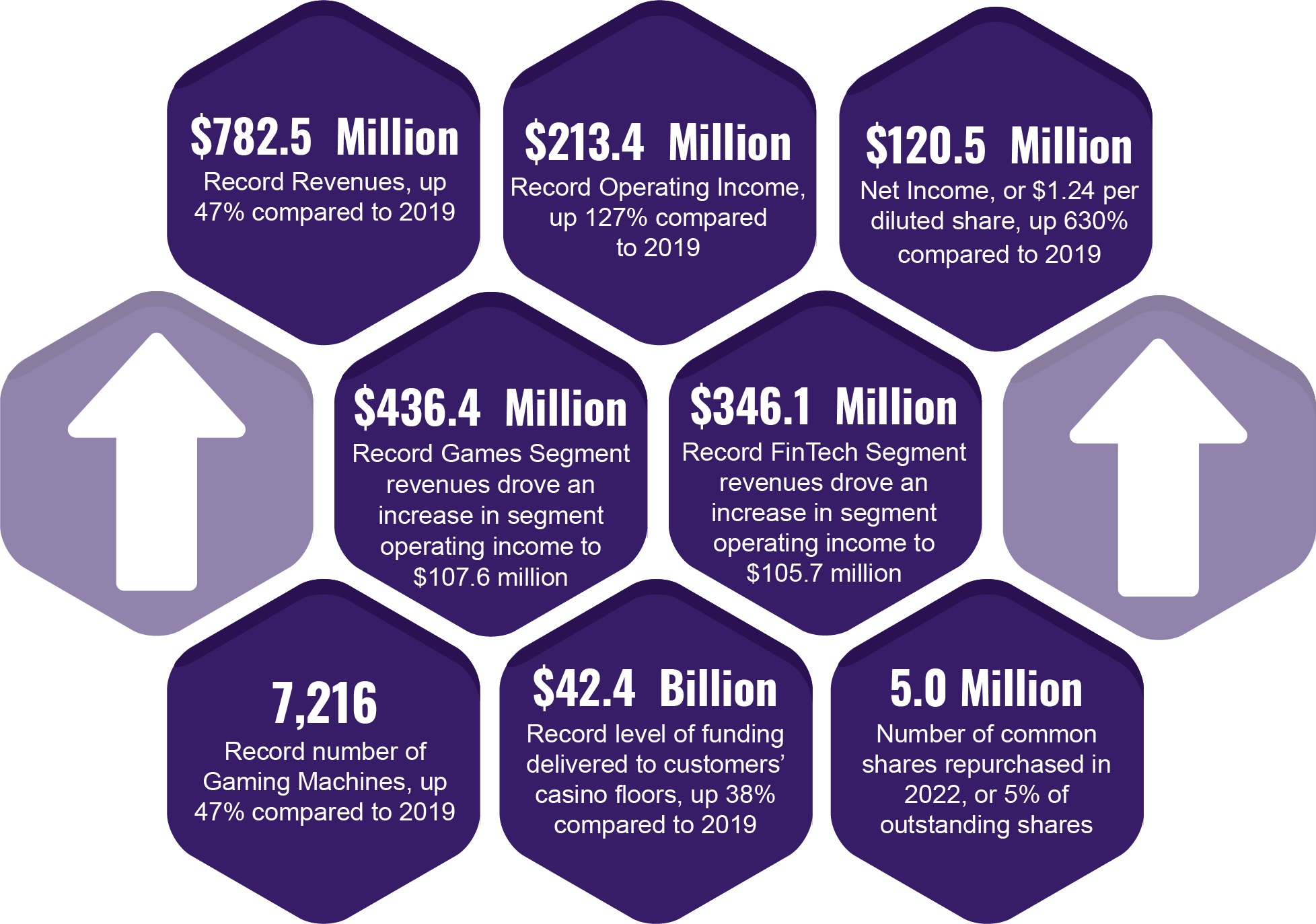

20202022 Performance Highlights |

Throughout 2020, we responded

Everi achieved ongoing growth in 2022, with improved performance in each operating segment. Total Consolidated Company Revenue (“ Total Revenue”) grew to $782.5 million, an 18% increase compared to 2021 Record revenues in both the challenges posed by the COVID-19 pandemicGames and its impact on our Company, our customers, and the gaming and hospitality industry while continuingFinTech segments drove an 8% increase in operating income to execute on our key growth initiatives. At the onset of the pandemic in March 2020, as it impacted our industry and we faced an immediate future of no revenues and no incoming cash flow, we acted swiftly. The leadership team took actions$213.4 million compared to reduce expenses, conserve liquidity, and plan for the survival of the Company.

Approximately 80 percent of the Company’s workforce were placed on furlough, salaries were reduced for remaining employees, and we implemented remote working and safe workplace policies. To lead the way, the Board of Directors and Chief Executive Officer cut their compensation to zero, with 70 percent reductions for the executive team, and smaller reductions for those employees earning less. In April 2020, the Company2021. Net income was able to secure an additional $125 million in borrowings, which together with cash on hand and its revolving credit line, provided liquidity for the Company while casinos were closed. Everyone demonstrated his/her dedication across the Company and accepted sacrifices to help the Company become well positioned to weather a prolonged period of little-to-no revenue.

Fortunately, the first casinos reopened their doors in late May, and during the next few months, more customers restarted operations and casino patrons returned. As customers reopened, we brought back furloughed employees, implemented policies designed to provide a safe workplace return, and began to restore compensation. With a majority of our gaming customers reopening properties by the end of September 2020, and our activity rates and results continuing to improve through the third and fourth quarter, we: (i) reinstated base compensation to pre-COVID-19 levels for the employee base and retroactively restored a significant portion of the reduced salaries with one-time catch up payments; (ii) although not promised at the time of

reduction, reversed nearly all compensation reductions for both our executives and directors; and (iii) fully paid down the outstanding balance on our revolving line of credit.

Through our dedication and unwavering commitment to provide our customers and their patrons with exceptional products and services, our 2020 fourth quarter operating results reflected quarterly sequential improvement over the third quarter, despite the continued impact from the COVID-19 pandemic and related casino closures. In addition, we were able to return to net income in the fourth quarter.

In the 2020 fourth quarter, revenues rose to $119.6 million from $112.1 million in the 2020 third quarter, and net income improved to $1.1$120.5 million, or $0.01$1.24 per diluted share, compareda decrease from 2021, largely due to a net loss of $0.9 million, or $(0.01) per diluted share,large, one-time, non-cash tax benefit received in the 2020 third quarter.

Additionally, the creative talents and commitment of our employees were recognized with our premium game, The Vault®, winning the Gold Medal for Best Product in the Gaming Industry2021 for the 2020 Global Gaming Business Gaming & Technology Awards, which consecutively follows winningreversal of a valuation allowance on certain deferred tax assets. The 2022 financial results are significantly better than the performance achieved in 2019, the last full year before the impact of the Gold Medal last year as well. Our digital mobile CashClub Wallet® solution for casinos was awarded the Silver Medal for Best Consumer Technology, the third consecutive year of such recognition for our FinTech business.COVID-19 pandemic.

The fourth quarter also saw the first deployment of our new digital, cashless CashClub Wallet® solution at two customers. Powered by our CashClub Wallet® technology, our offering provides operators with a cashless, touchless, flexible, robust, secure, regulatory-compliant, and cost-effective payment method capable of providing their guests with a seamless experience across their entire gaming and resort amenities of the casino.

For more information on our 20202022 results and other related financial measures, we refer you to our 20202022 Annual Report.

CAUTIONARY INFORMATION REGARDING FORWARD-LOOKING STATEMENTS AND WEBSITE REFERENCES

This Proxy Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including as they relate to our expectations, goals, or plans related to corporate responsibility, sustainability and environmental matters, employees, policy, business, procurement and other risks and opportunities, as do other materials or oral statements we release to the public. Forward-looking statements are neither historical facts nor assurances of future performance, but instead are based only on our current beliefs, expectations, and assumptions regarding the future of our business, plans and strategies, projections, anticipated events and trends, the economy, and other future conditions, as of the date on which this report is filed, and these are subject to change, including the standards for measuring progress that are still in development. All statements other than statements of historical or current facts, including statements regarding our strategy, our operational objectives, and our environmental and social plans and goals, made in this document are forward-looking and aspirational, and are not guarantees or promises such expectations, plans, or goals will be met. Forward-looking statements often, but do not always, contain words such as “expect,” “anticipate,” “strive,” “aim to,” “designed to,” “commit,” “intend,” “plan,” “believe,” “goal,” “target,” “future,” “assume,” “endeavor,” “estimate,” “seek,” “project,” “promote,” “may,” “can,” “could,” “should” or “will,” and other words and terms of similar meaning.

Forward-looking statements are subject to inherent risks, uncertainties, and changes in circumstances that are often difficult to predict and many of which are beyond our control. Our actual results and financial condition may differ materially from those indicated in forward-looking statements, and important factors that could cause them to do so include, but are not limited to, the risks and uncertainties described in our 20202022 Annual Report on Form 10-K.

We undertake no obligation to update or publicly revise any forward-looking statements as a result of new information, future developments or otherwise. All subsequent written or oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by this section. You are advised, however, to consult any further disclosures we make on related subjects in our reports and other filings with the Securities and Exchange Commission (the “SEC”). Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

Corporate Governance Highlights

Our Board has developed strong corporate governance practices to promote long-term value creation, transparency, and accountability to our stockholders. Highlights of our corporate governance policies and structure following the Annual Meeting include:

| | | | | | | | |

| |

WHAT WE DO

|

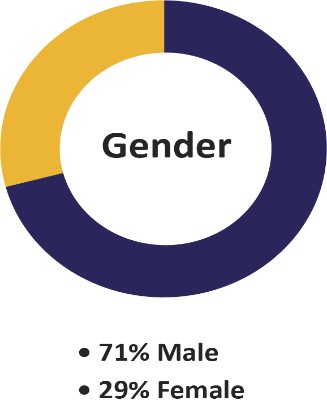

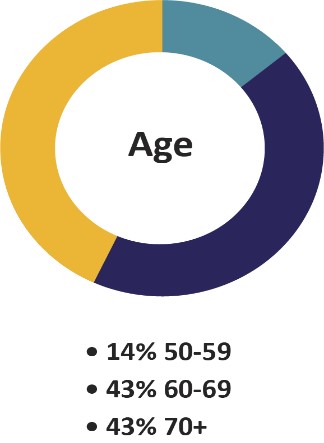

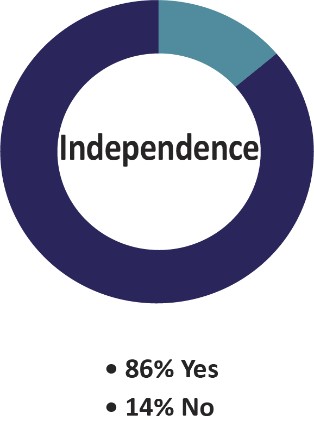

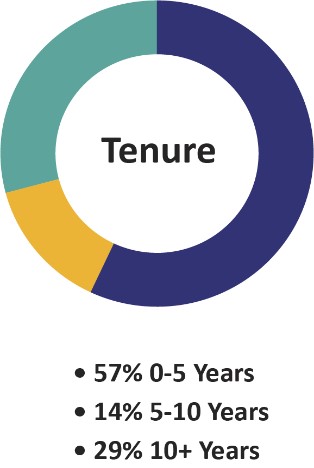

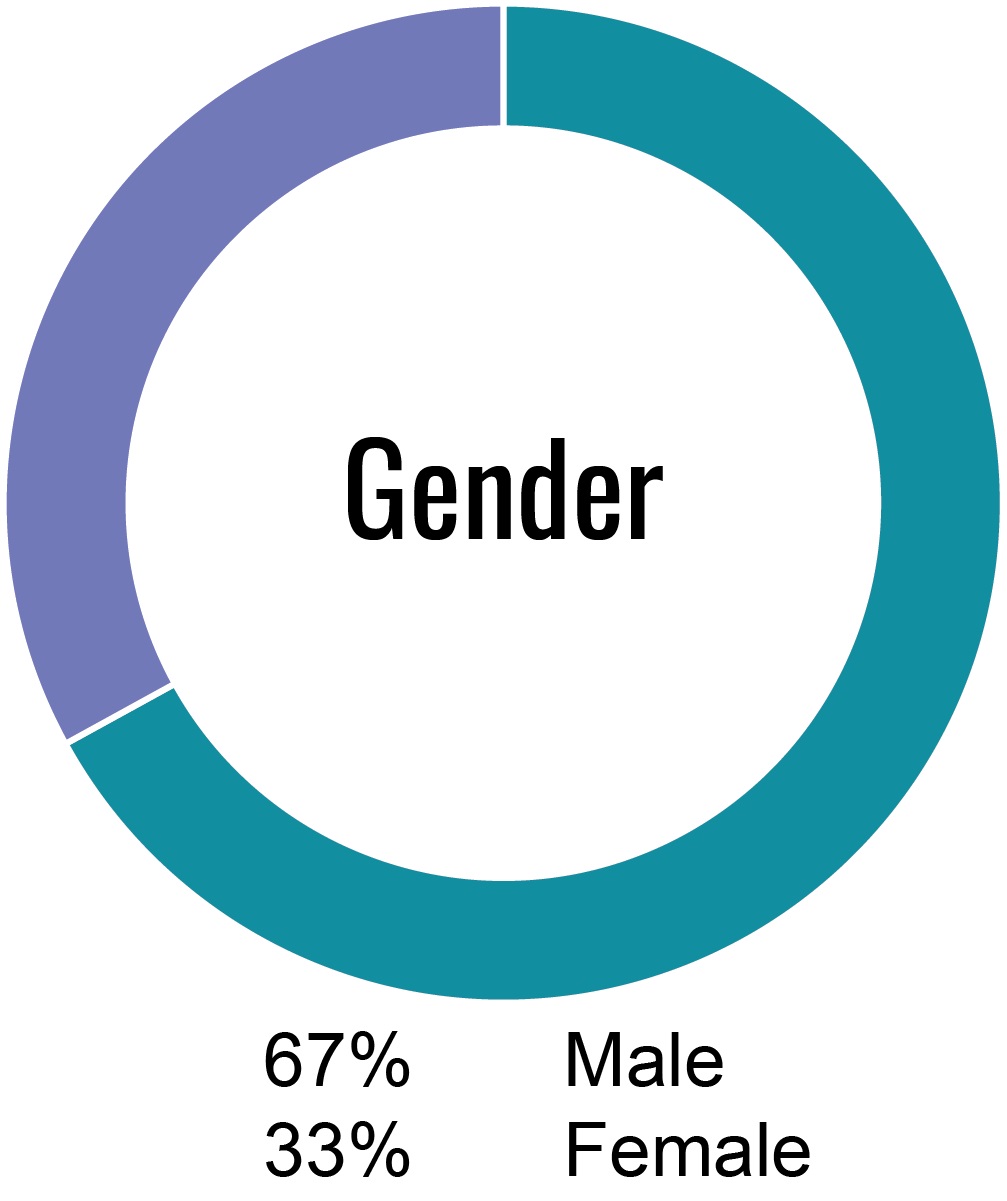

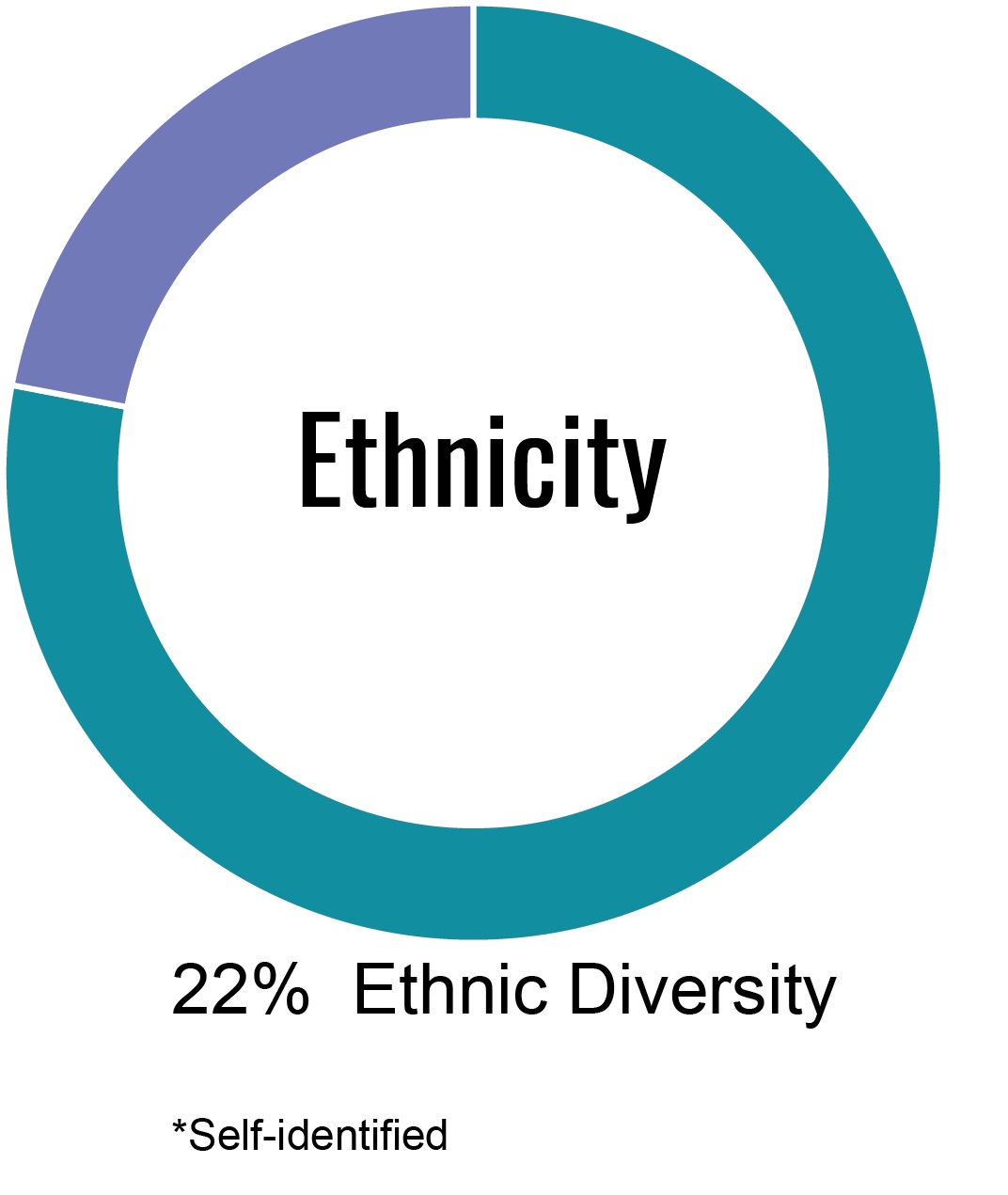

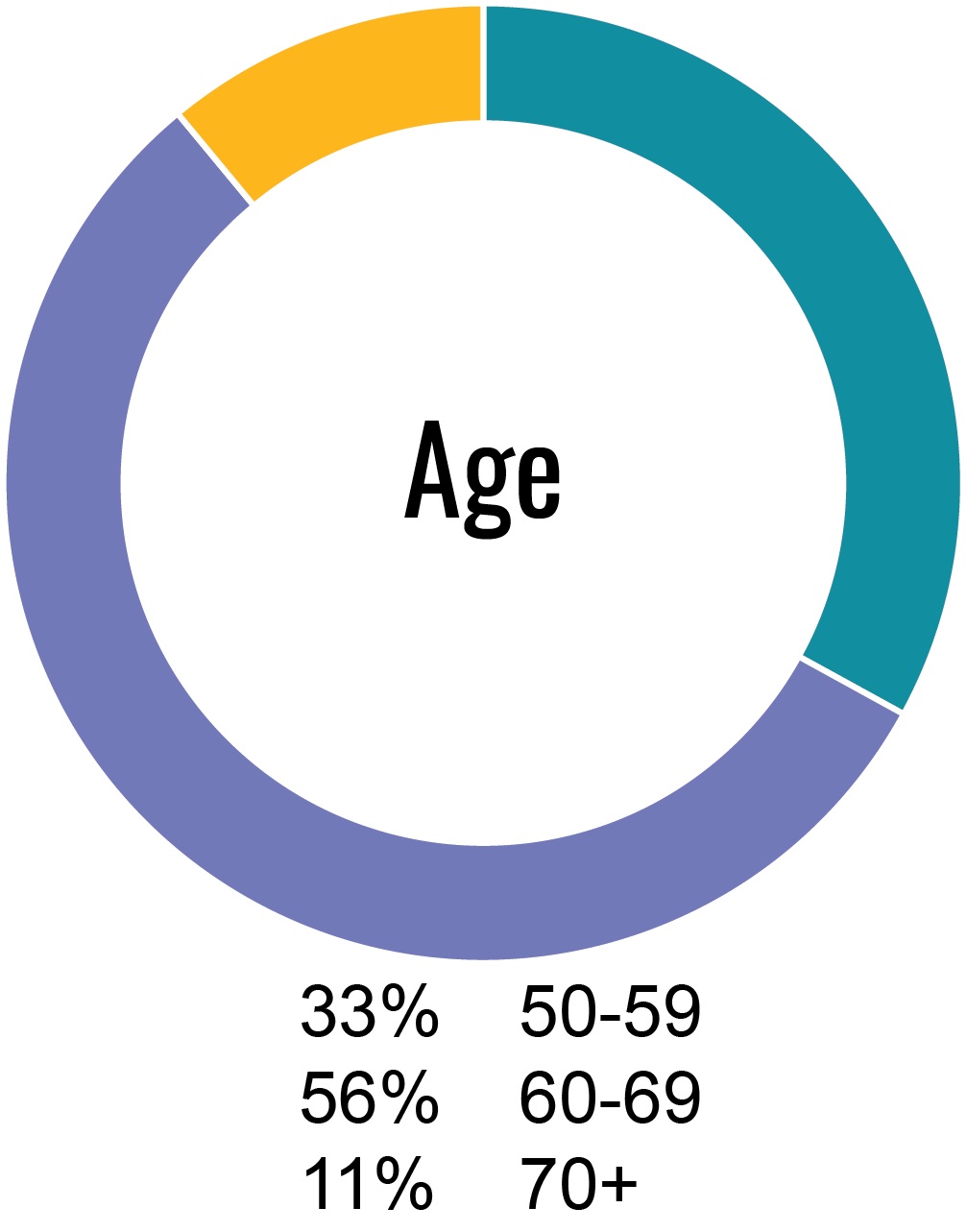

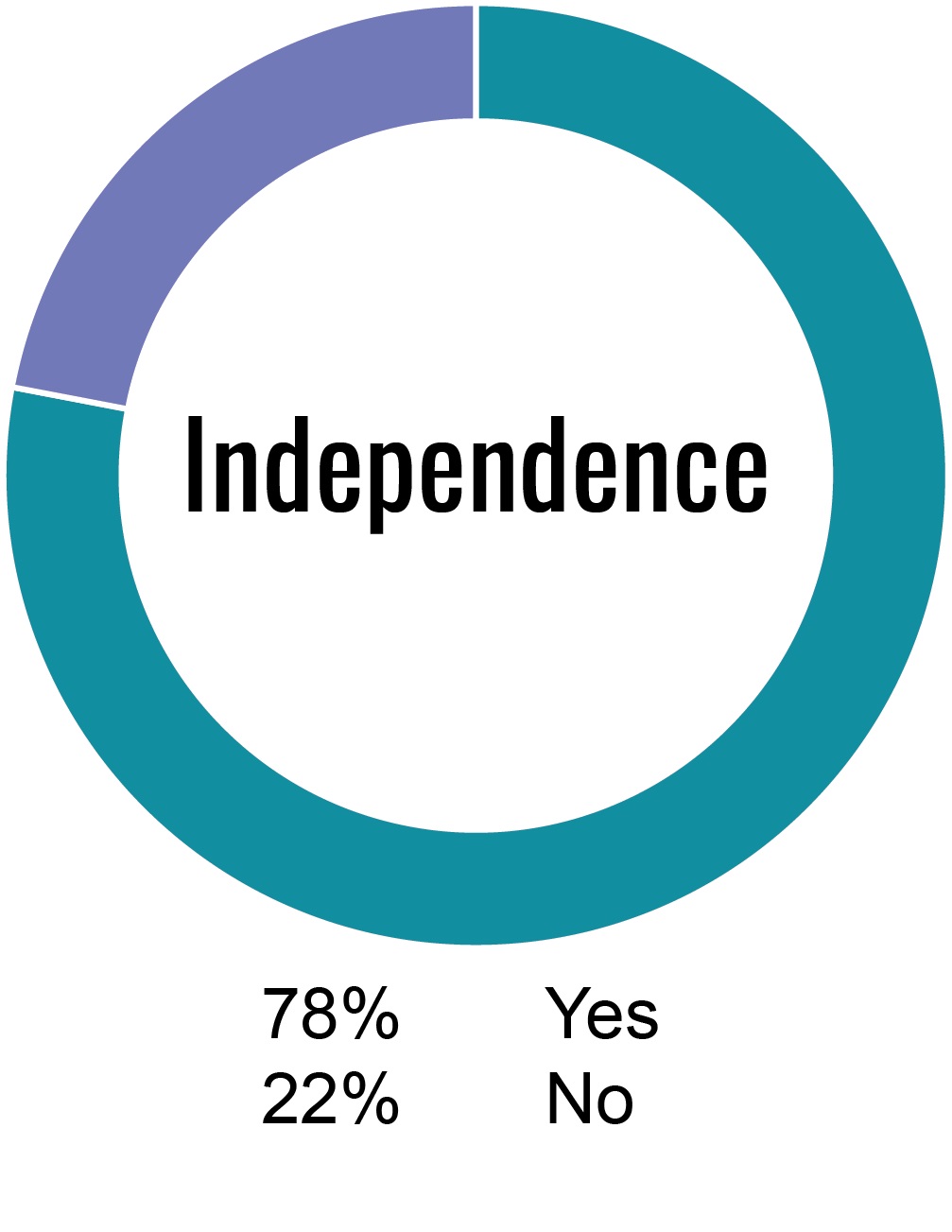

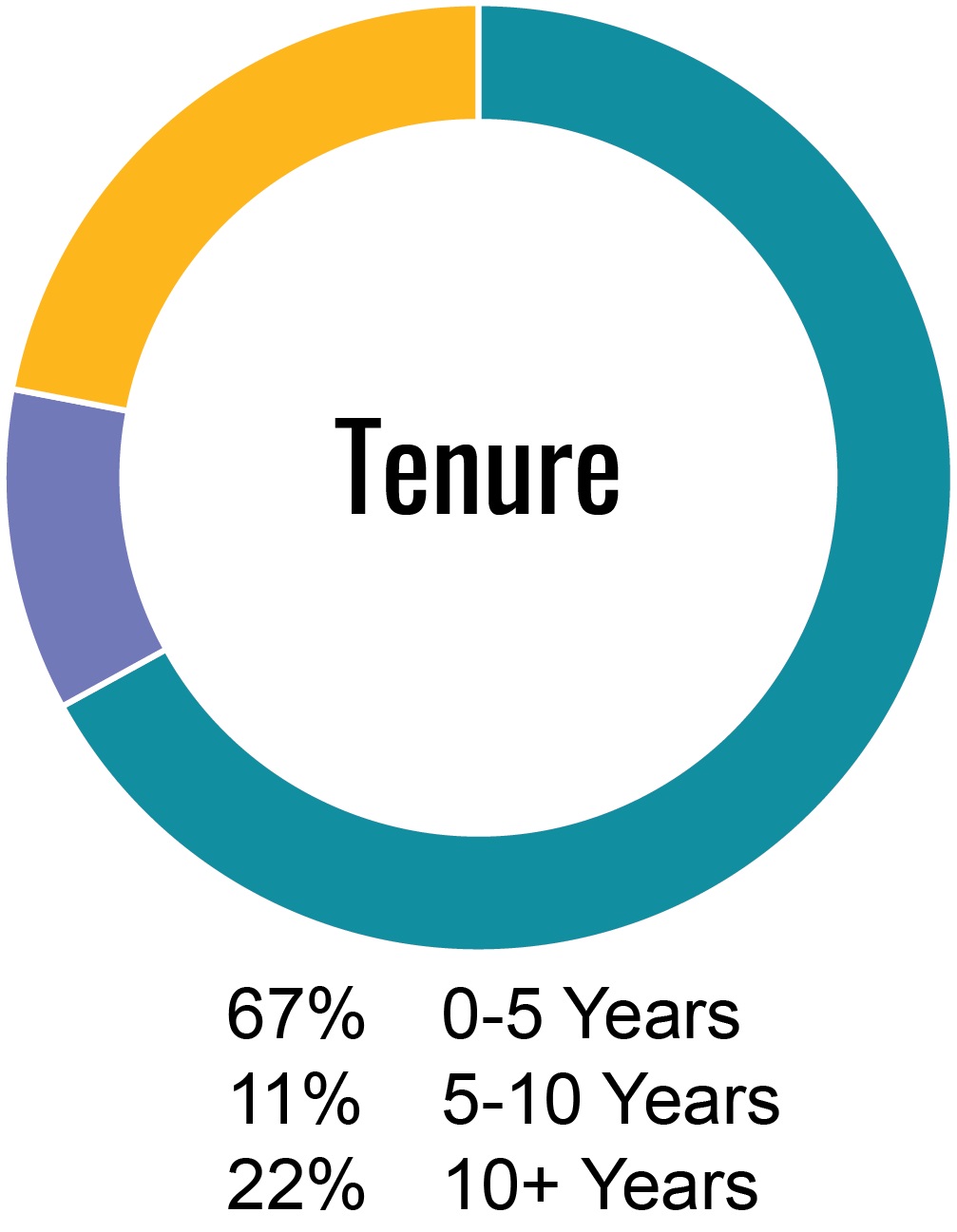

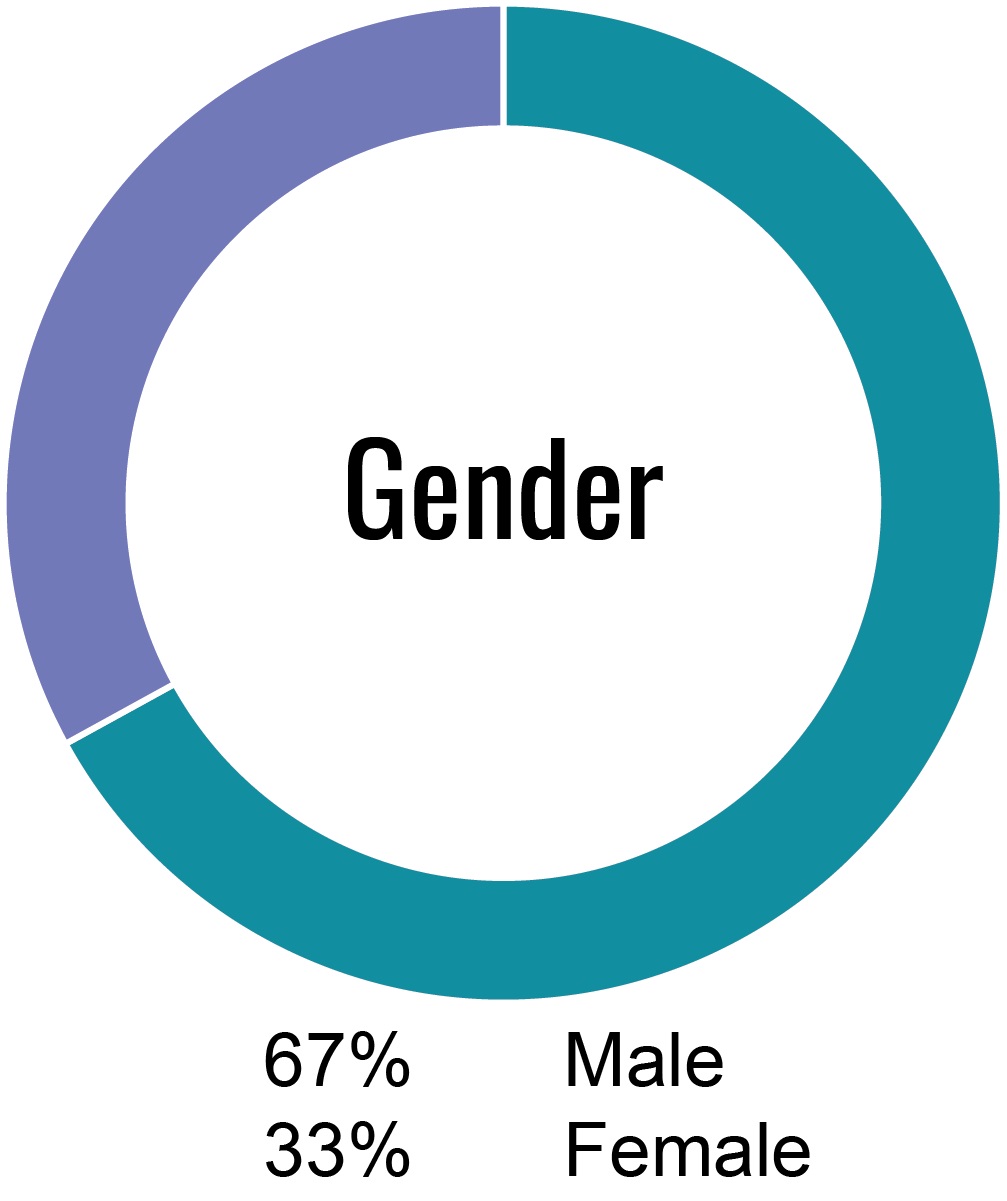

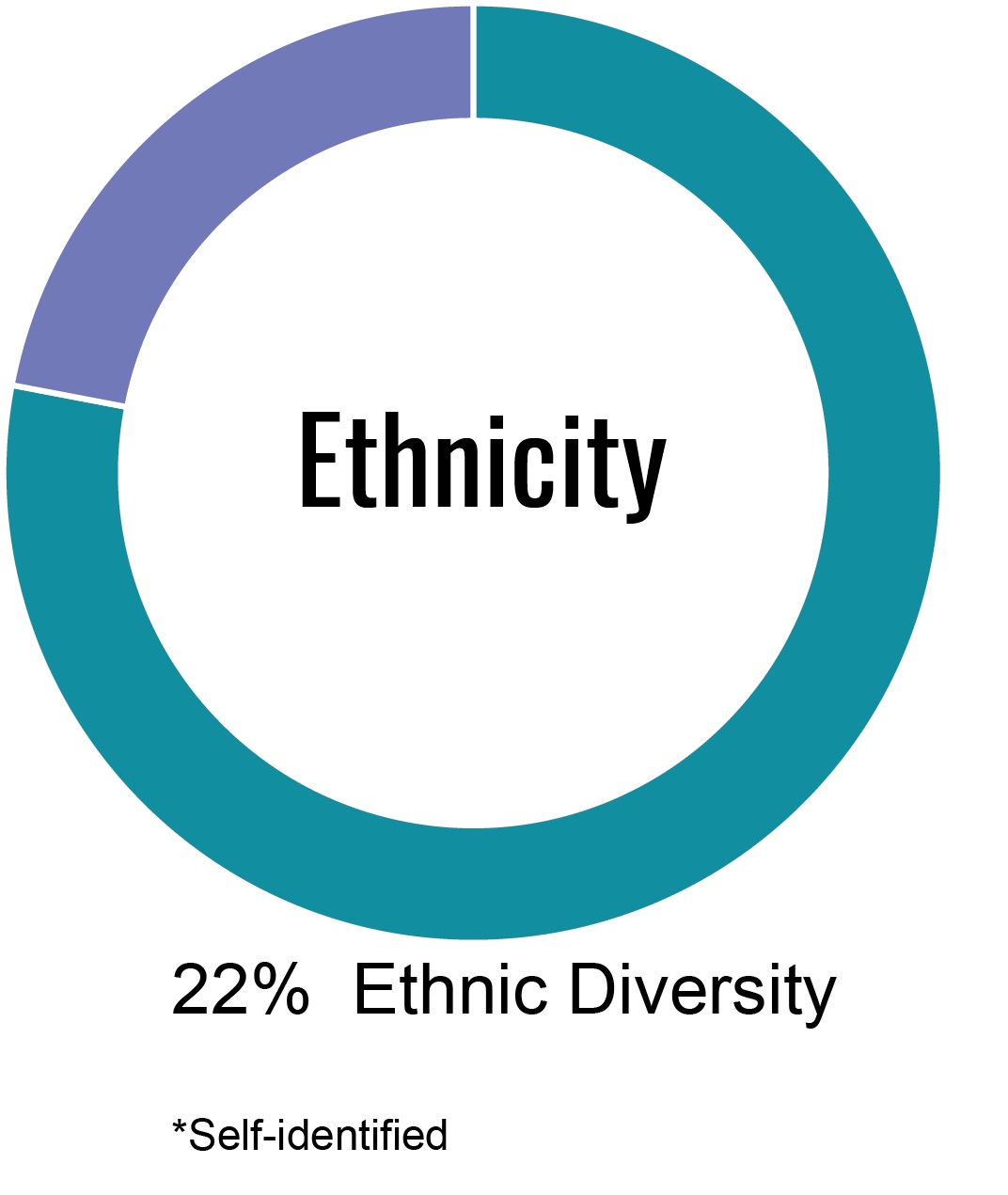

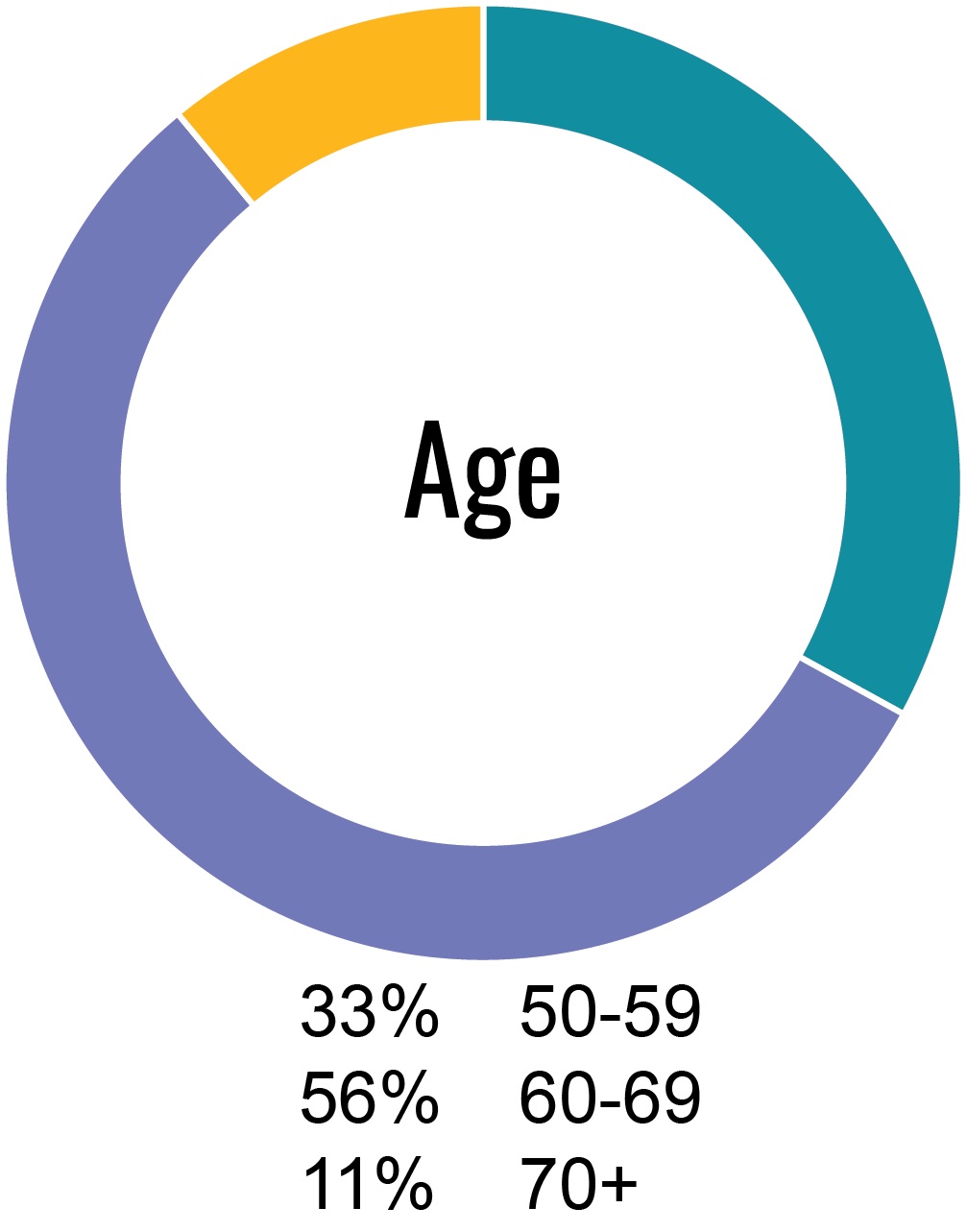

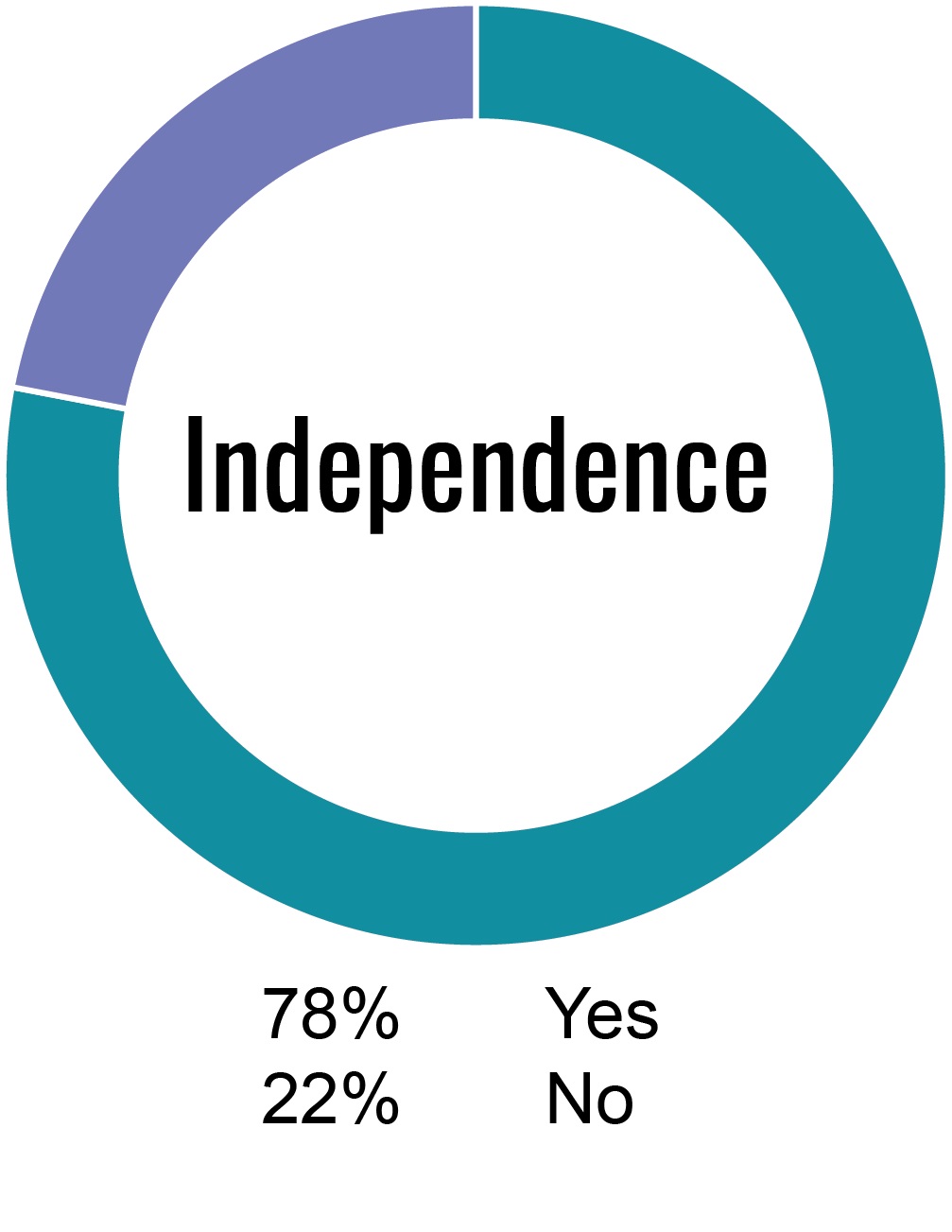

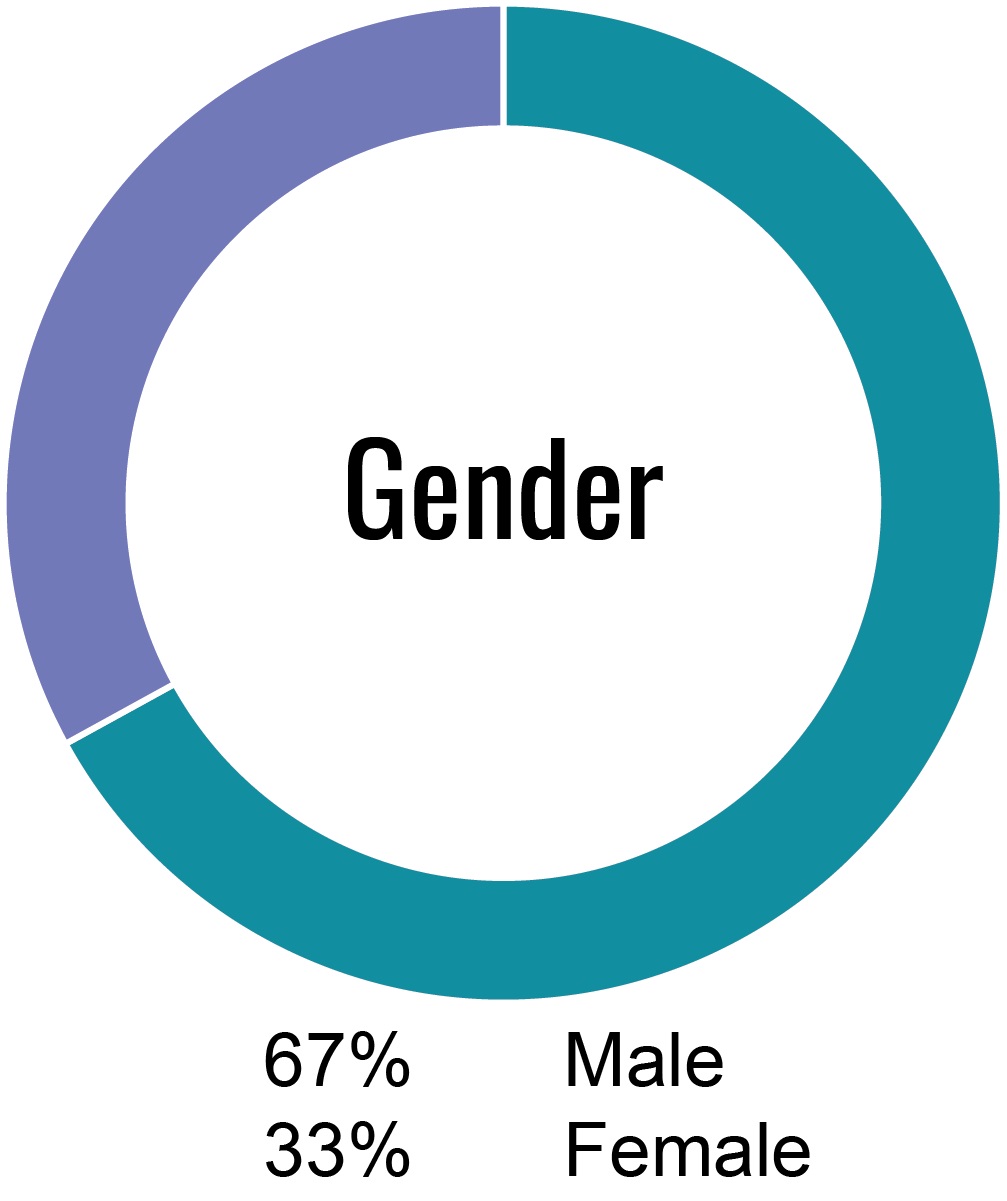

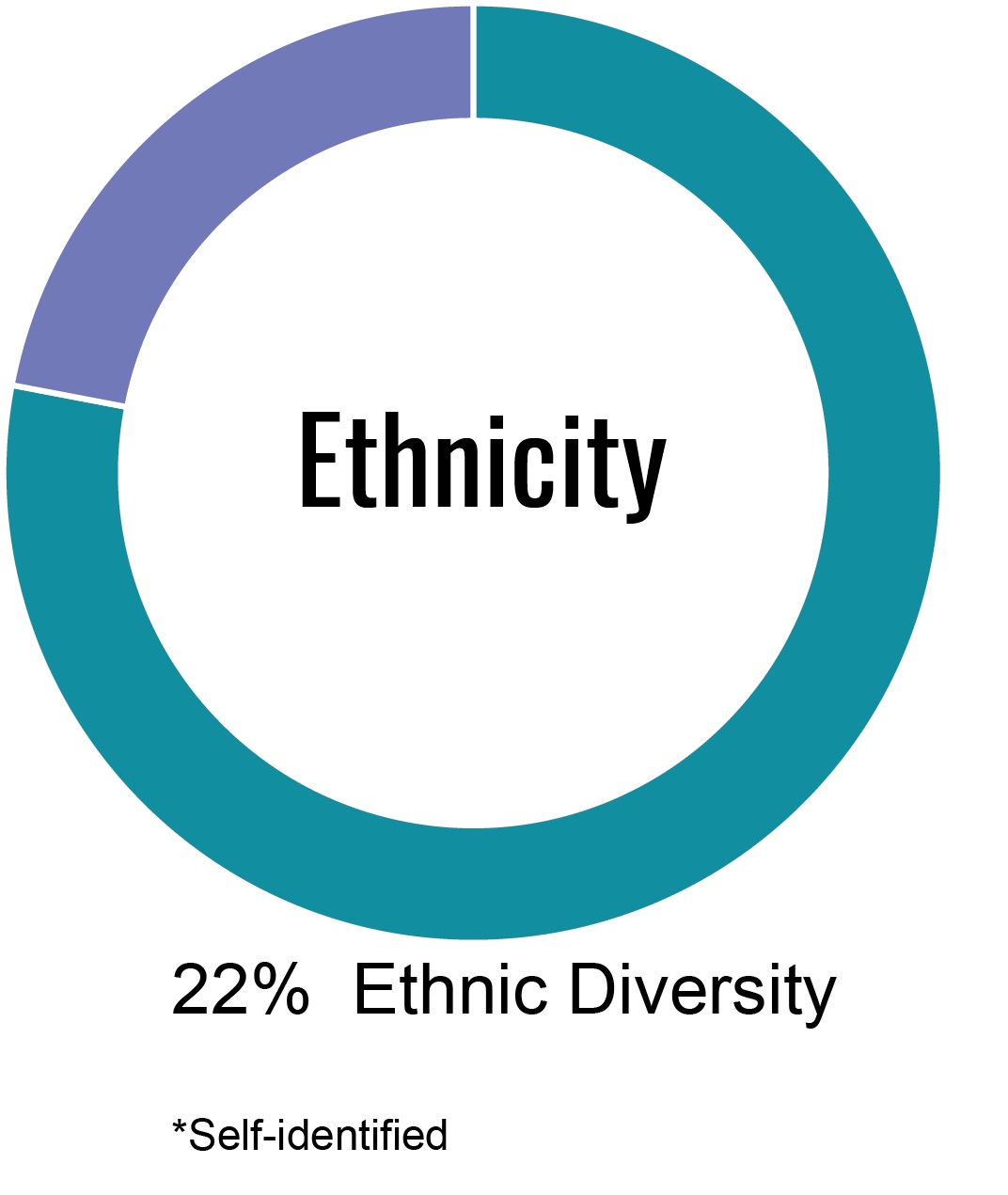

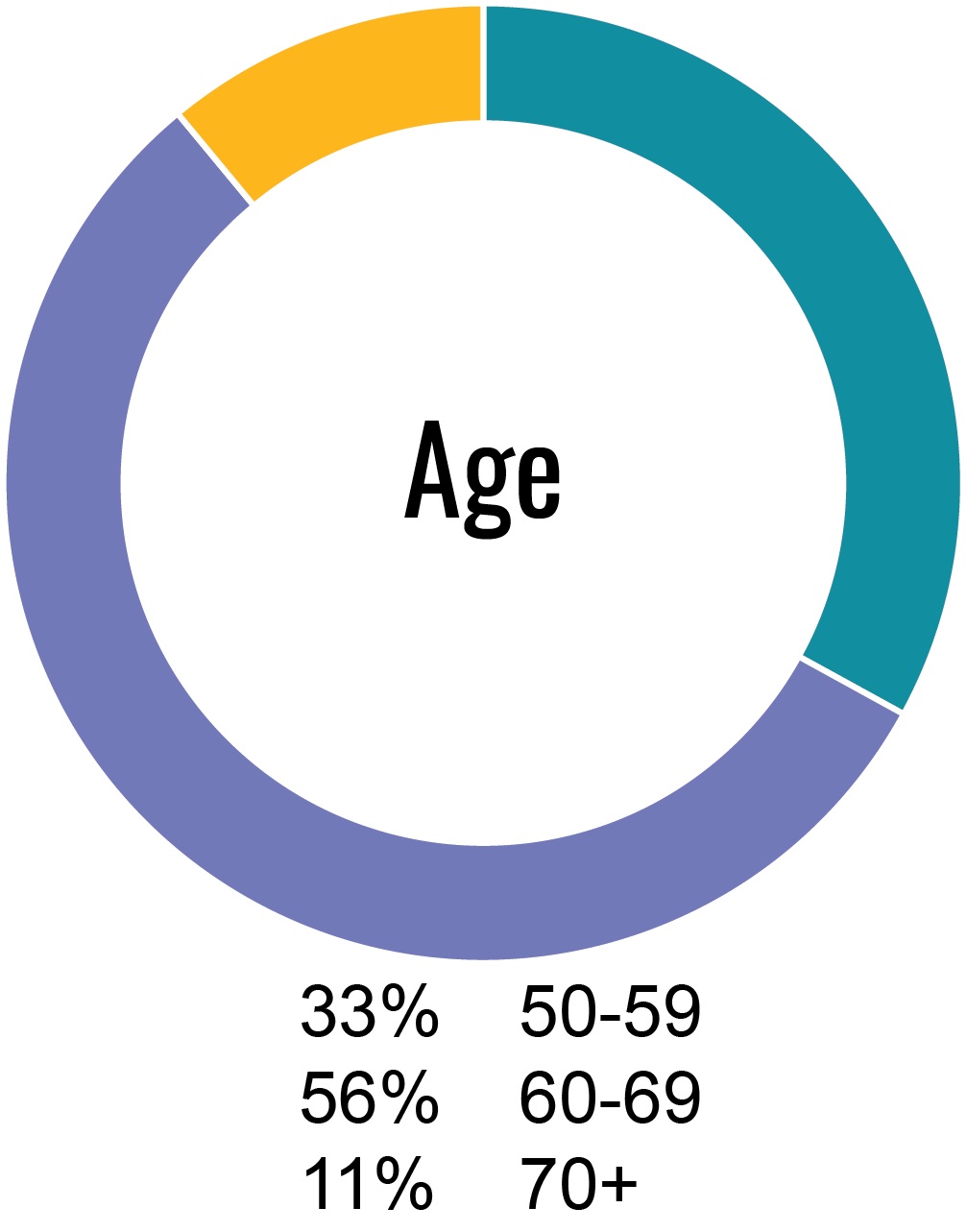

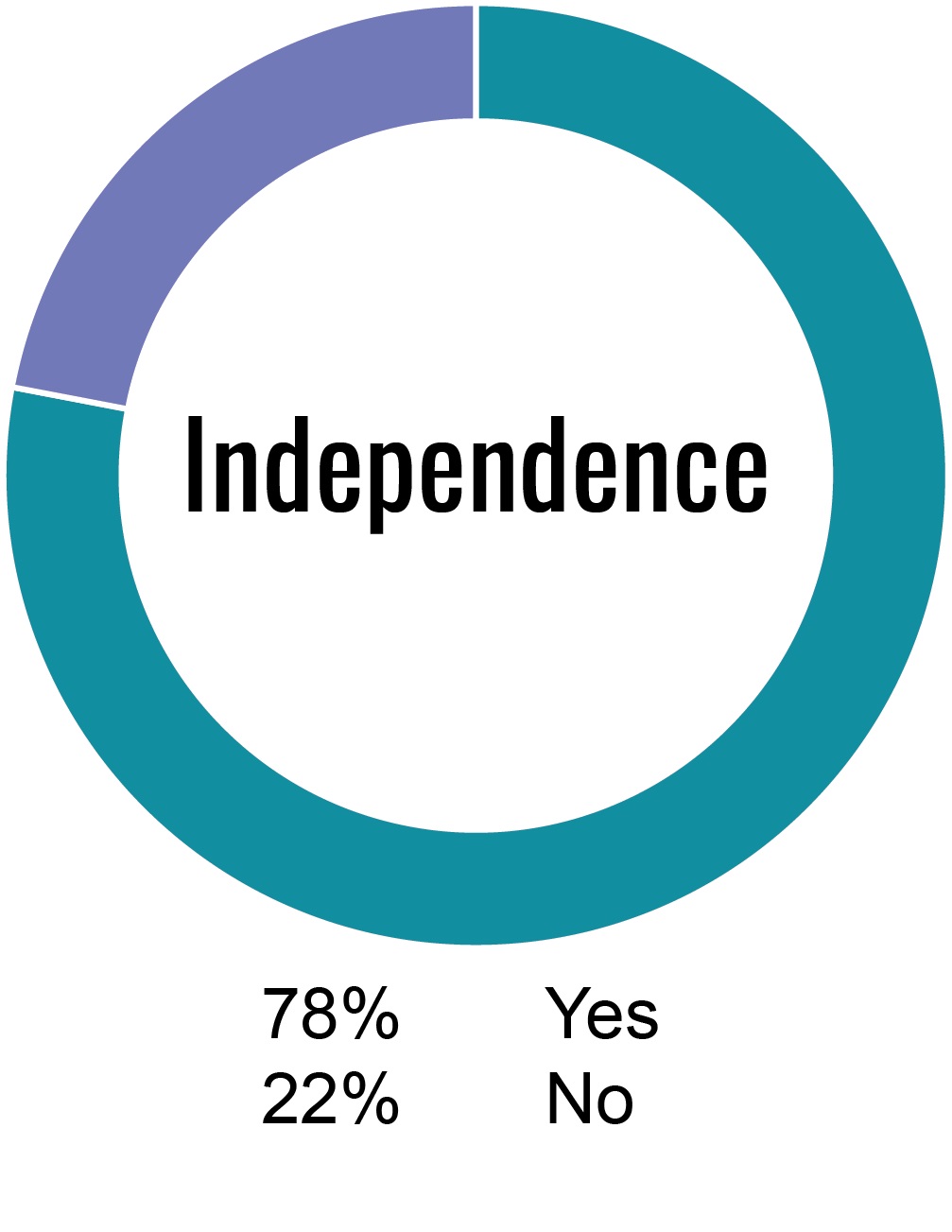

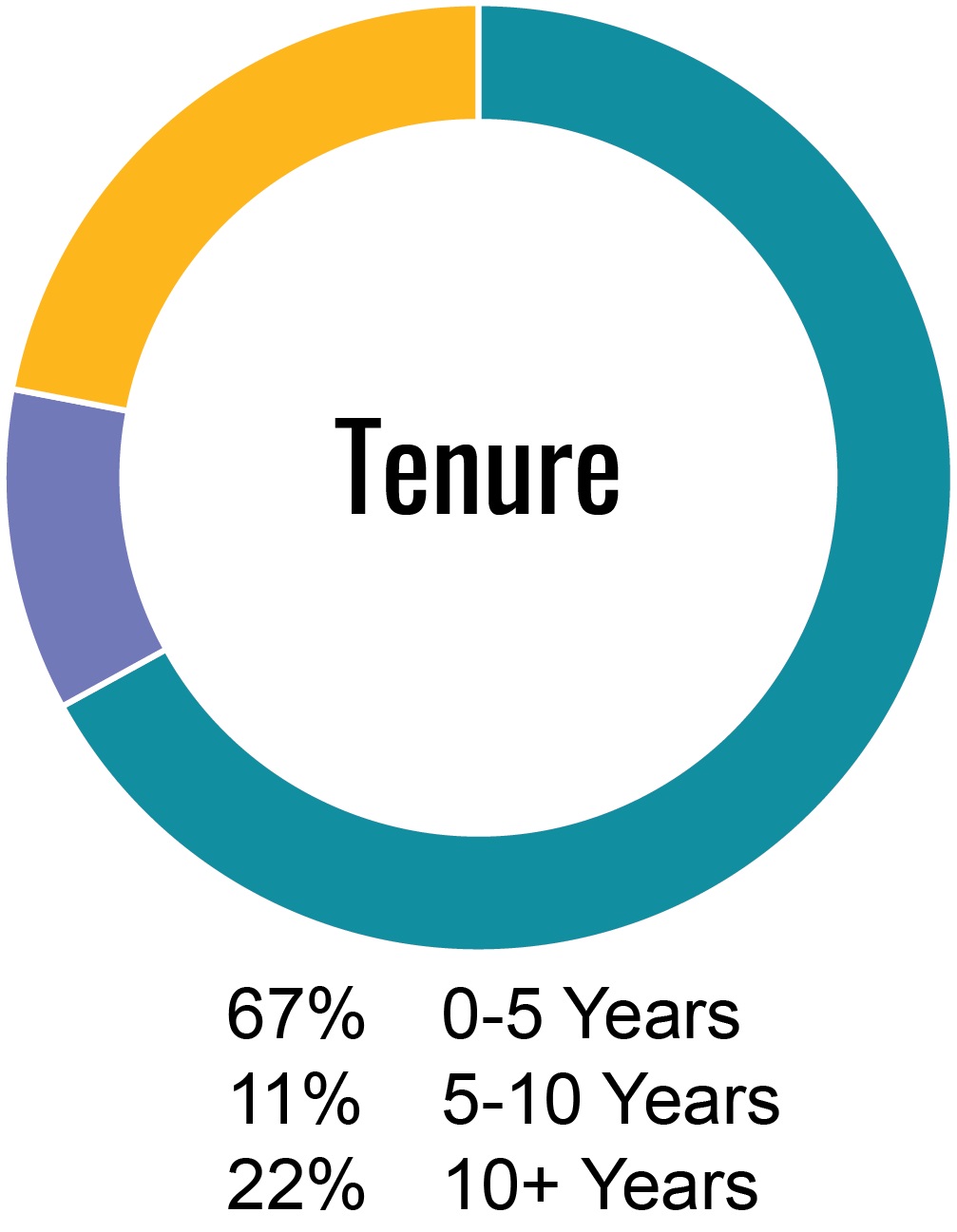

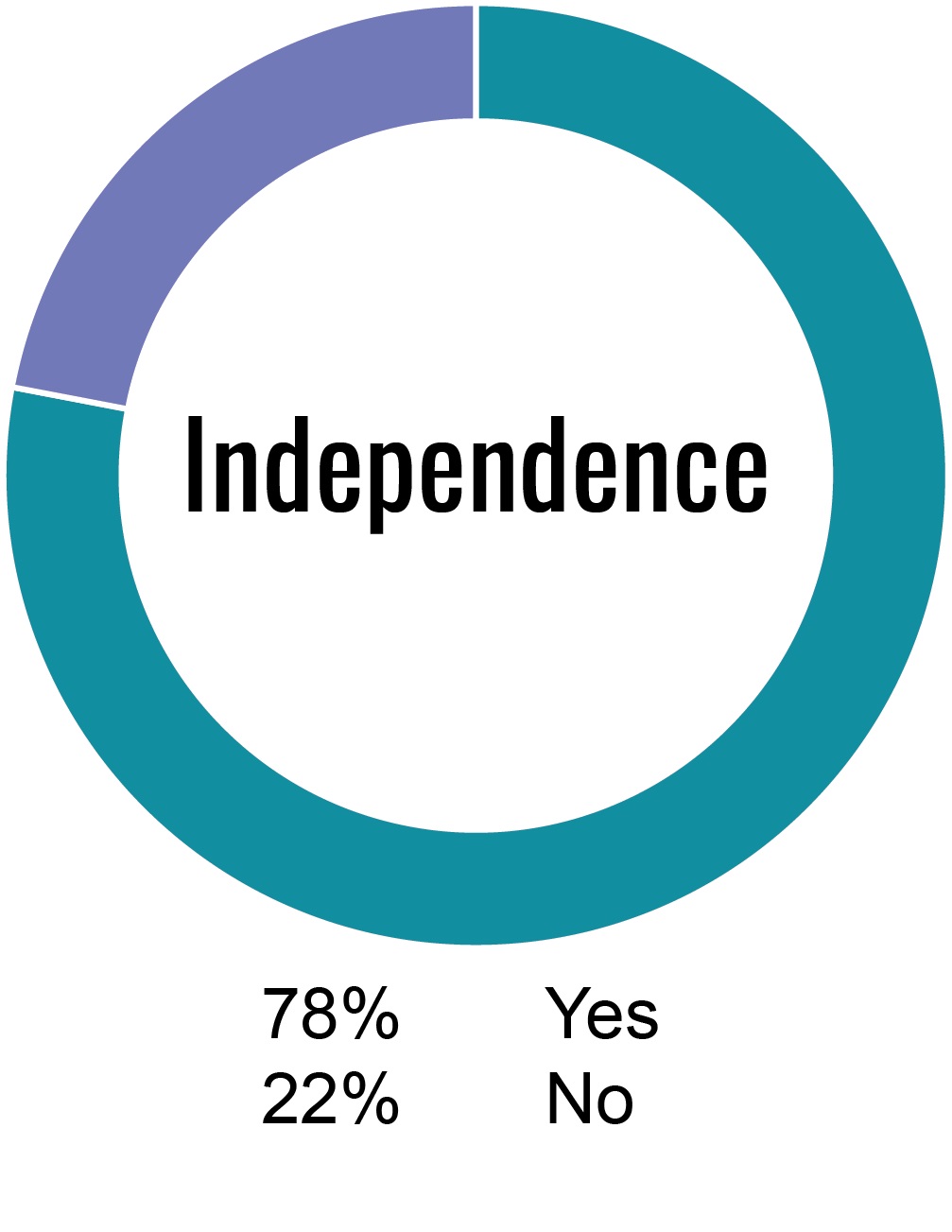

| | •86%78% Independent Directors - 67 of 79 •29%33% Female Directors - 23 of 7 (Including9 (Including Chair of Nom GovCompensation Committee) •14% Ethnic Diversity of Directors (Self-Identified) •100% attendance at our Board and Committee meetings in 2020

•"Plurality-Plus" Voting for Directors (mandatory resignation policy for nominees who fail to receive an affirmative majority of votes cast)

•Limitations on Outside Public Company Board Service •Lead Independent Director •Separate Chair of the Board and Chief Executive Officer •Entirely Independent Committees •Audit Committee Financial Experts - 4 of 67 •Annual Board and Committee Self-Evaluations •Systemic Risk Oversight by Board and Committees •Environmental, Social, and Governance (“ESG”) Oversight by Board and Committees •Cybersecurity and Information Technology Oversight by Board and Committees •Regular Executive Sessions of Independent Directors •Investor Outreach Program •Equity Ownership Policy with required holdings for Directors and Executives •Cash and Equity Compensation Clawback Policy •Annual Say on Pay Advisory Vote •"Double-Trigger" for Change in Control Severance Payments •Ongoing Board Refreshment Planning •Executive Succession Planning Process •Comprehensive Code of Business Conduct, Standards and Ethics,Ethics; Supplier Code of Conduct,Conduct; and Corporate Governance Guidelines •Board and Committee Authority to Engage Independent AdvisorsCompliance Hotline |

| | | | | | | | |

| |

WHAT WE DON’T DO

|

| | •Poison Pill •Allow Pledging of Our Securities •Allow Hedging of Our Securities •Repricing ofReprice Stock Options without Stockholder Approval •Allow Cash Buyouts of Underwater Stock Options without Stockholder Approval •Grant Excess Perquisites •Allow Excise Tax Reimbursements for PerquisitesGross Ups |

| | | | | |

| |

Environmental , Social, and Governance (“ESG”) Environmental Sustainability

|

Environmental SustainabilityOur industry. Our communities. Our world. We focus on the responsibility we have as a financial technology provider and gaming equipment supplier to respect our environment. To support our efforts we have a number of Company-wide programs in place to help protect the environment, including: Reducing Resource Consumption and Waste, Recycling and Parts Refurbishment, and Lowering Carbon Emissions. |

Water

Reducing Resource Consumption and Electricity | Waste | Our ongoing initiatives to improve working remotelyinclude consolidating facilities and our physical footprint, as well as supporting remote work for certain positions. We know that these efforts are beneficial to our sustainability efforts, including reduction of our energy, water, and paper consumption. In 2020, we reduced We strive to reduce overall water and consolidatedelectricity usage in our existing domestic offices and production facilities, and in this regard have made the number of our officefollowing investments: installed LED lighting, motion-activated lights and facilities locations from 14 to 10, with plans to further reduce our office space by approximately 70,000 square feet by June 2021, effectively reducing our carbon footprint. faucets, low-flow toilets, and water filtration systems. We have implemented recording and reporting protocols at our domestic corporate headquarters and other officeadministrative offices and manufacturingproduction locations to monitor our environmental impact at those locations, and commencesupporting our progress towards setting long-term sustainability targets.

|

| | |

Recycling and Parts

Refurbishment | | We currently have recycling partners in place for industrial material used in the manufactureassembly of our products, including paper, cardboard, electronics,certain electronic components, and certain metals. We also work with our suppliers and shippers to repurpose wooden pallets batteries,and packaging materials used in shipping our products. In our Games segment, we refurbish and metals,redeploy approximately 40% of our gaming devices at least once during the device’s lifetime, as well as consumerrepurpose individual component parts to the extent possible. In our FinTech segment, servers and network equipment, including end-of-life hardware for our Automated Teller Machines (“ATMs”) and fully integrated kiosks, are also recycled. We also have recycling partners in place for copy paper plastics, and aluminum inrecycling at nearly all of our domestic administrative offices and production facilities. In addition,2022, we shredded and recycled approximately 55,000 pounds of paper from our primary Las Vegas, Nevada and Austin, Texas facilities.

|

| |

Lowering Carbon Emissions | Everi’s focus on achieving a reduced carbon footprint and preservation of our precious water supply includes using nearly 100% renewable energy to host our data at the facilities of our data center co-location vendor, Switch. This green energy supply is generated by Nevada solar farms and Western Electricity Coordinating Council hydroelectric plants.

The Company is dedicated to the leasing or purchasing of hybrid or electric vehicles (“EV”) for its field service personnel, and intends to retire and replace its existing vehicle inventory with such vehicles over a period of time. To date, such purchases have been limited due to supply chain constraints and lack of development of EV service-type vehicles.

In 2022, the Company entered into a lease agreement for a new facility being developed in our Games business, we redeploy component partsLas Vegas, Nevada, that upon completion, will consolidate the assembly and electronicdistribution of its gaming machines previously done in Austin, Texas with our cash access kiosks, loyalty kiosks, and other FinTech products currently assembled in Las Vegas. The new Las Vegas facility, which is designed to cohere to environmental and sustainable stewardship practices during construction and operation, is expected to streamline production and simplify both supply chain processes and the extent possible.distribution of completed products to customers. The new facility is being built to Everi’s specifications to encompass environmental sustainability and create an employee-friendly working environment and is anticipated to meet the certification level of 3 Green Globes science-based rating system established in accordance with the Green Building Initiative. The facility will utilize such elements as low-water landscaping, energy efficient windows, automated LED lighting, high-efficiency plumbing, energy-usage tracking, and solar panels engineered to offset nearly 80% of the power needs, all in an effort to lessen the environmental impact of the facility. |

| | | | | | | | |

Social Responsibility | | |

Social Responsibility |

| We are committed to contributing positively to our communities and to creating and sustaining a positive work environment and corporate culture that fosters employee engagement, health, safety, well-being, diversity and inclusion and equal opportunity. We progress towards this through a focus on recruitment and retention of employees with skills. |

Corporate Culture | | We arefoster an industry leader and keenly aware of the importance of this role as we strive to also be an industry-leading corporate citizen. We foster ainclusive culture among our employees so that the WHY of why we work at Everi reflects our shared commitment to positively impact our employees, partners, customers and their guests, stockholders, communities, and the environment. To build this culture we have invested in programs and implemented standards to promote the community, responsible gaming efforts, ethical business conduct, diversity,comprehensive human capital management (diversity and inclusion, talent attraction, retention and development, and rewards) sustainability, giving and volunteerism,volunteerism. In 2021, we created an internal ESG Committee, led by our CEO and responsible gamingGeneral Counsel and comprised of Company employees across various business areas and professional levels, which functions as a central task force for our ESG initiatives. Our ESG Committee meets on at least a monthly basis to discuss the Company’s ESG framework, identify action items to pursue, review progress with our ESG efforts, discuss recent developments and trends, and to collect feedback from members on potential additional initiatives, activities, and next steps. Our Board receives quarterly reports at its Board meetings on ESG developments, trends, and the Company’s ESG framework, initiatives, and activities and holds discussions with senior management regarding the efficacy of our efforts. We believe that we believethese efforts will supportcontribute to our long-term business success, while also bringing positive, lasting contributions toempower our communities.team members, and support our Core Company Values: Collaboration, Integrity, Inclusion, Excellence, and Fun. |

| | |

Policies

Diversity and Principles | Inclusion | We review our Corporate Governance Guidelinesstrive to embrace and other governance policies annually. We recently updated our Supplier Code of Conduct to outline our values and expectations for responsible business practiceslive by one of our third-party suppliers and reinforce our commitment to the improvement of economic, environmental, and social conditions through our business activities and in the same tone and spirit of our own commitments.

|

| | |

Diversity and Inclusion | | key Company values: Inclusion. We recognize that we can only be at our best only when we embrace and reflect the diversity of not only our employees, but the customers and communities that we serve. We believe diverse backgrounds, perspectives, and talents will enable us to continue to be successful and drive shareholder value. In 2017, we launched our Women'sThe efforts to support diversity in leadership at Everi start with the Board. Currently 33% of Everi’s Board members are female and 22% are ethnically diverse. Female Board member, Secil Tabli Watson, is a member of Extraordinary Women on Boards, a private membership community for highly accomplished women actively serving on corporate boards. Our most recently elected female board member, Debra L. Nutton, served as an original board member of Global Gaming Women and was honored by Global Gaming Women with the 2018 Great Women of Gaming Lifetime Achievement Award.

Everi’s Women’s Leadership Initiative (“WLI”): Everi continues to develop andwork to advance gender diversity, throughout the organization and to create new opportunities, and a path for advancement.increase the representation of women in our workforce through the WLI. To date, over 165 employees have participated in the training, educational, and networking opportunities offered, with the class of 2022 being the most inclusive to date, consisting of approximately 60 members across North America, including fully remote team members. We continue to be committed to maintaining a diverse and inclusive work environment and have implemented mandatory employee-wideFocusing on the importance of training, Company-wide diversity and inclusion training initiatives to continueis mandatory for employees and is intended to cultivate an inclusive, engaging, and respectful workplace, and includes separate training on the impact of bias in the selection and hiring processes that is mandatory for hiring managers. Further, in 2022, our executive leadership team set the example for the Company by participating in separate inclusive leadership training. Our total combined hours for mandatory diversity and inclusion training were approximately 2,800 hours for 2022, including supplemental training for hiring managers and the executive leadership team.

|

| |

Diversity in Hiring | In March 2022, the Company entered into a respectful workplace. These training initiatives address challenges like unconscious biasstrategic agreement with the Partnership for Youth Success® Program of the U.S. Army. Through this program, the Company has the opportunity to post open positions for consideration by service women and micro inequities,service men upon their transition from their military service. Upon viewing a position of interest that is in line with their background and offer employees suggestionsexpertise, soldiers can then reach out to the Company to seek an interview. Qualified candidates will be guaranteed an interview and they will be considered for navigating these challenges, to help us createemployment.

In November 2022, the Company and Grant a workplace where all contributions are valued, andGift Autism Foundation (“GGAF”) entered into a range of voices heard.strategic partnership in connection with GGAF’s WORKS Intern Vocational Program. |

| |

| | | | | | | | | | | |

| Social Responsibility - Continued |

Diversity and Heritage

Celebrations | As part of the celebration of Women’s History Month in March 2022, the Company hosted for its employees “A Seat at the Table: A Chat with Everi Board Members,” with guest speakers Eileen Raney, Maureen Mullarkey, and Secil Tabli Watson, to share some of their personal stories as well as insights and advice they have learned throughout their journeys, and in August 2022, in celebration of Women’s Equality Day, the Company also hosted for its employees “A Discussion with Patty Becker.” (Ms. Becker is a leader who has held both governmental and private sector roles in the gaming industry). In March 2023, the Company’s People Operations department (formerly the Company’s Human Resources, or HR department) hosted a webinar, “Telling Your Story,” for its employees. In May 2022, we also celebrated Military Appreciation Month by recognizing Everi employees and their family members who have served or are actively serving in our armed forces in a commemorative video, as well as a donation to the non-profit organization, K9s for Warriors. In October 2022, we recognized Disability Employment Awareness month where we educated employees that “Inclusion is within Everi-one’s Ability” via a weekly email campaign highlighting how we can respect and better accommodate our fellow employees with disabilities. Please refer to page 33 herein for more information on Everi’s Diversity and Heritage Celebrations.

|

| |

Employee Engagement, Satisfaction & Awards | | We value continuous dialogueSixteen Top Workplaces Awards Since 2021 Aligning with our values of Inclusion and Collaboration, we endeavor to engage with our employees on a regular basis, seeking feedback about their experiences. Weexperience at Everi. Through an annual employee engagement survey for the Top Workplaces program, our employees shared their positive feedback and belief in Everi. Looking at the results of this survey, 87% of employees at Everi feel that their manager cares about their concerns, ranking the Company in the Top 11% of all participating companies in the entertainment, hospitality and casino gaming industry. The Company was also ranked in the top 5% of all participating entertainment, hospitality and casino gaming companies because so many of our employees agreed that they have several employee feedback mechanisms including opinion surveys, Company-wide email communications,the work-life flexibility they need. TOP WORKPLACES AWARDS: In 2022 and quarterly Town Hall meetings, among other mediums.through March 2023, Everi received: *Recognition on a national level as one of the “Top Workplaces 2022 USA” *Additional Culture Excellence Awards for categories: Compensation & Benefits, Employee Appreciation, Employee Well-Being, Innovation, Leadership, and Work-Life Flexibility (in addition to the two Culture Excellence Awards received in 2021) *For a second year, received a regional award as “”Nevada Top Workplaces 2022,” and “Greater Austin Top Workplaces 2022” *For a second year, received certification as a Great Place to Work® in India *In March 2023, Everi received “Top Workplaces 2023 USA,” and has been featured in Energage’s list of Top 100 companies with 1,000 - 2,499 employees. .

|

| |

Community Engagement,

Giving, and Volunteerism | Community Engagement: Throughout the year the Company focuses on different heritage celebrations, holidays, and commemorations. We seek to connect with our employees to build awareness through educational webinars and guest lecturers, and we directly address employee feedback through these mechanismsengage with the communities in which we operate by donating to increase employee confidence that their feedback will leadvarious support organizations. Everi was issued a certificate regarding utilization of funds in India for the financial year 2022-2023, disbursed for Corporate Social Responsibility activities in India, specifically, the Company’s contribution to actionthe Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund, a fund established to respond to emergency and distress situations such as posed by management.the COVID-19 pandemic. Charitable Contributions: In 2022, the Company made charitable contributions across many deserving organizations, showcased on our Corporate Social Responsibility webpage at: https://www.everi.com/about-us/corporate-social-responsibility/.

|

| |

| | | | | | | | | | | |

Social Responsibility - Continued |

Responsible Gaming | | Over the years, the Company has worked with dozens of leading responsible gaming associations across the globe to develop a set of comprehensive tools to help prevent problem gamblers from obtaining funds in a casino. The Company's initiatives and controlled solutions are designed to enable casinos to enhance their promotion of responsible gaming while helping them comply with local laws, customs, and culture in the prevention of problem gambling. Everi’s Personal Self Transaction Exclusion Program (“STeP”) is a way for patrons to block access to cash across the Company’s national network of ATMs, financial access kiosks, and booth services. Our CashClub Wallet™ also includes a self-imposed velocity and transaction limits as a supplement to our existing STeP program. |

| |

Benefit Enhancements | As a result of input received from Company employees through our 2022 annual benefits survey, we implemented enhanced benefits effective January 1, 2023, including: •For the eighth year in a row, no increases to employee premiums (contributions) to medical, dental, and vision benefits •An increase in the 401(k) match provided by the Company •New partnership with a new medical provider •New partnership with a new pharmacy benefit provider •Addition of new Second Medical Opinion option •Extension of the mental health and wellness program with easy access to preventative care, self-care and professional services, including virtual coaching sessions

|

| | |

Accolades | | Named a Winning 'W' Company by 2020 Women on Boards for achieving at least 20 percent women on its board of directors before the year 2020. One of these board members, Eileen F. Raney, was a keynote panelist on "The National Conversation on Board Diversity" event sponsored by 2020 Women on Boards, and continues to be an active contributor to the organization.

Human Capital | |

| | | |

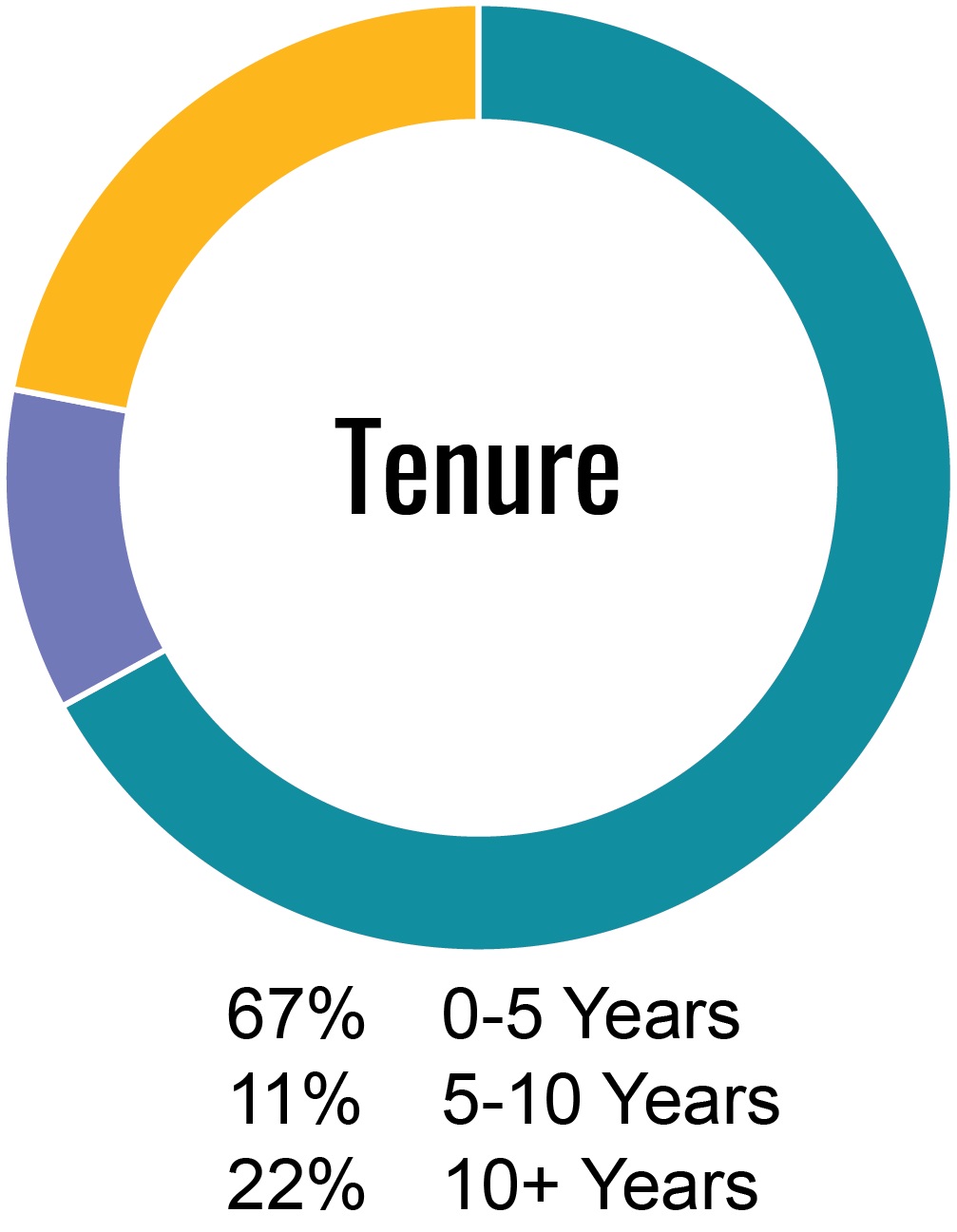

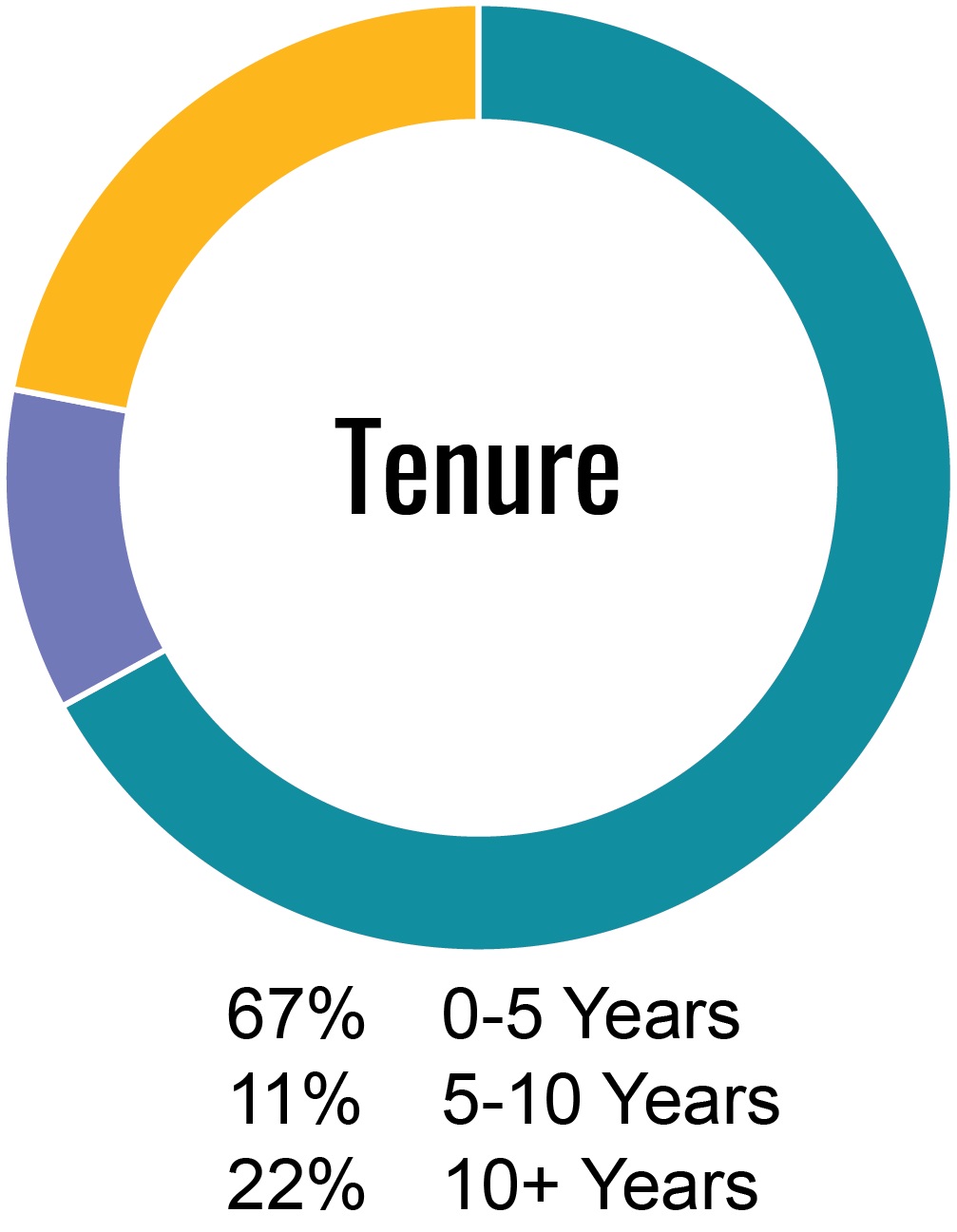

Human Capital Management

| | In addition to our Corporate Culture initiatives, Everi implemented programsinitiatives to support internalcareer growth, training and external career development opportunities, offer attractive employee benefits,new talent acquisition and diverse recruiting, and actively solicitsolicited employee feedback.For additional information on Everi’s Human Capital initiatives and programs, please refer to page 31 herein, and pages 13-15 of the Company’s 2022 Annual Report. |

| | | | | | | | | | | |

| Governance |

We are committed to maintaining high standards of corporate governance, which we believe promotes long-term value creation, transparency, and accountability to our stockholders. Our commitment to corporate governance is integral to our business and reflects not only regulatory requirements, New York Stock Exchange (“NYSE”) listing standards, and broadly recognized governance practices, but also effective leadership and oversight by our senior management team, the Nominating and Governance Committee (“Nom Gov” or “Nom Gov Committee”) of the Board, and the Board.

|

For information on Everi’s Governance initiatives, please refer to “Corporate Governance Highlights”(pages 10-11herein); “Board and Corporate Governance Matters” (pages 24-28 herein); “CorporateGovernance”(pages 36-40 herein); and “Compensation Governance Practices” (page 56 herein). |

For additional information on Everi’s ESG initiatives and programs, please refer to page 28 herein, page 13 of the Company’s 2022 Annual Report, and the Company’s Corporate Social Responsibility webpage at: https://www.everi.com/about-us/corporate-social-responsibility/.

| | |

PROPOSAL 1 ELECTION OF TWOTHREE CLASS IIII DIRECTORS (Item No. 1 on the Proxy Card) THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE NOMINEES NAMED BELOW. |

| | |

Qualifications of Our Class IIII Director Nominees: |

þ Ms. Raney Mr. Fox and Mr. BaliMses. Mullarkey and Watson are independent.

þ Ms. Raney Mr. Fox and Mr. Bali have been determined to be financial experts

þ Ms. RaneyMses. Mullarkey and Mr. Bali,Watson, respectively, have 6+, 4+, and 1+ years of service on our Board.

þ The twothree nominees are highly qualified, experienced, diverse, and actively engaged individuals.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Principal (or Most Recent) Occupation | | Current Committees |

| Eileen F. Raney | | 71 | | 2016 | | Former member of the Board and a member of the Audit, Compensation, and Governance Committees of the Board of SHFL entertainment, Inc., a global gaming supplier that was acquired by Bally Technologies, Inc. in November 2013 | | •Audit Committee •Compensation Committee •Nominating and Corporate Governance Committee (“Nom Gov Committee” or “Nom Gov”) |

| Atul Bali | | 49 | | 2019 | | Non-executive Chairman of the Board of Meridian Tech Holdings Ltd., a regulated global emerging markets sports betting and online gaming firm, operating in Europe, Latin America, and Africa | | •Audit Committee •Compensation Committee •Nom Gov Committee |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director Since | | Principal (or Most Recent) Occupation | | Current Committees |

| Linster W. Fox | | 73 | | 2016 | | Retired and previously served as Executive Vice President, Chief Financial Officer and Secretary of SHFL entertainment, Inc., a global gaming supplier, from 2009 up until the company’s acquisition by Bally Technologies, Inc. in November 2013 | | •Audit Committee (Chair) •Compensation Committee •Nom Gov Committee |

| Maureen T. Mullarkey | | 63 | | 2018 | | Retired and previously served as Executive Vice President and Chief Financial Officer of International Game Technology (currently known as International Game Technology PLC), a leading supplier of gaming equipment and technology | | •Audit Committee •Compensation Committee (Chair) •Nom Gov Committee |

| Secil Tabli Watson | | 51 | | 2022 | | Board of Directors of Bank of Marin Bancorp (NASDAQ: BMRC) and its subsidiary, Bank of Marin

| | •Audit Committee •Compensation Committee •Nom Gov Committee |

Our Certificate of Incorporation provides that the number of directors that shall constitute the Board shall be exclusively fixed by resolutions adopted by a majority of the authorized number of directors constituting the Board. The Company’s Bylawsbylaws state that the authorized number of directors of the Company shall be fixed in accordance with the Company’s certificateCertificate of incorporation. The authorized number of directorsIncorporation. Effective January 21, 2022, the Board, acting upon the recommendation of the CompanyNom Gov Committee, increased the size of the Board to ten members. The Board is currently set at eight.comprised of nine members and the Board continues to evaluate the composition of the Board and consider potential director candidates. Our Certificate of Incorporation and Bylawsbylaws provide that the Board shall be divided into three classes constituting the entire Board. The members of each class of directors serve staggered three-year terms. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. As of the filing of the Proxy Statement, the Board is composed of the following eightnine members:

| | | | | | | | | | | |

| Class | Directors | Term Commencement | Term Expiration |

| I | E. Miles Kilburn, Eileen F. Raney,Atul Bali(1), Paul W. Finch, Jr.(2), and Atul Bali(1)Randy L. Taylor(3)

| 2018 Annual Meeting of Stockholders | 2021 Annual Meeting of Stockholders | 2024 Annual Meeting of Stockholders |

| II | Geoffrey P. Judge, Michael D. Rumbolz, and Ronald V. CongemiDebra L. Nutton(4) | 2019 Annual Meeting of Stockholders | 2022 Annual Meeting of Stockholders | 2025 Annual Meeting of Stockholders |

| III | Linster W. Fox, and Maureen T. Mullarkey, and Secil Tabli Watson(5) | 2020 Annual Meeting of Stockholders | 2023 Annual Meeting of Stockholders |

___________________

(1)Mr. Bali’s term of office as Lead Independent Director began on November 4, 2019, when he was appointed to the Board.effective as of May 18, 2022.

(2)Mr. Finch’s term of office began effective as of February 1, 2022.

(3)Mr. Taylor’s term of office began effective as of April 1, 2022.

(4)Ms. Nutton’s term of office began effective as of April 1, 2023.

(5)Ms. Watson’s term of office began effective as of February 1, 2022.

Recent Board Changes

On April 2, 2021, E. Miles Kilburn,January 21, 2022, Ronald V. Congemi, a previous member of the Board since March 2005 and Chairman of the Board since 2008,February 2013, informed the Company that he willwould retire from the Board and willwould not stand for re-election at the Company’s 20212022 Annual Meeting. Therefore, Mr. Kilburn’sCongemi’s last day of service as a director, ChairmanLead Independent Director of the Board, and member of the Audit Committee, Compensation Committee, and Nom Gov Committee of the Board, will bewas May 19, 2021.18, 2022. The Board hasnamed Atul Bali, an independent member of the Board since November 2019, as Lead Independent Director, effective upon Mr. Congemi’s last day of service.

Upon the recommendation of the Nom Gov Committee, on January 21, 2022, the Board appointed Secil Tabli Watson and Paul W. Finch, Jr. as a Class III and Class I director, respectively, each to serve for a term expiring at the Company’s 2023 and 2024 Annual Meeting of Stockholders, and each as a member of the Audit Committee, Compensation Committee, and Nom Gov Committee of the Board, effective April 1, 2022.

The Board appointed Michael D. Rumbolz, a current memberpreviously serving jointly as Chair of the Board and Chief Executive Officer of the Company, to jointly serve as ChairmanExecutive Chair of the Board, effective as of April 1, 2022. Effective April 1, 2023, the Company entered into an Executive Chair Agreement (the “Agreement”) to reappoint Mr. Rumbolz to serve in the role of Executive Chair of the Board of the Company. Mr. Rumbolz’s Agreement with the Company will expire on March 31, 2025. As Executive Chair of the Board, Mr. Rumbolz is an employee of the Company, reporting directly to the Board, and is subject to the Company’s policies on the same basis as other senior executives of the Company. The Company requires that the Executive Chair be available to perform the duties of Executive Chair customarily related to this function, including, without limitation: (a) acting as Chair of the Board and stockholder meetings; (b) acting as a liaison between the Company’s senior management and the Board and its committees; (c) advising the Company’s senior management on matters of Company operations; and (d) otherwise performing the duties of Chair of the Board, as well as such other customary duties as may be determined and assigned by the Board, and as may be required by the Company’s governing instruments, including its certificate of incorporation, bylaws, and its corporate governance guidelines, each as amended or modified from time to time, and by applicable law, rule, or regulation, including, without limitation, the Delaware General Corporation Law and the rules and regulations of the SEC.

The Board appointed Randy L. Taylor as President and Chief Executive Officer, succeeding Mr. Rumbolz in the position of the Company upon Mr. Kilburn’s retirement. The Board named Ronald V. Congemi, an independentChief Executive Officer, and as a member of the Board, since 2013,effective as Lead Independent Director, effectiveof April 2, 2021.1, 2022. Mr. Taylor previously served as our President and Chief Operating Officer from April 1, 2020 to April 1, 2022, as our Executive Vice President, Chief Financial Officer and Treasurer from March 2014 through March 2020, and as our Senior Vice President and Controller from November 2011 to March 2014.

Upon the recommendation of the Nom Gov Committee of the Board, on March 3, 2023, the Board has nominated Eileen F. Raneyelected to fill an open vacancy and Atul Bali, currentappointed Debra L. Nutton as a Class I Directors ofII Director to serve for a term expiring at the Company, for election as Class I Directors of the Company. Mr. Bali was recommended to the Board for appointment by Michael D. Rumbolz, Chief Executive Officer of the Company. If elected, each will serve a three-year term until the 2024Company’s 2025 Annual Meeting of Stockholders, and as a member of the Audit Committee, Compensation Committee, and Nom Gov Committee of the Board, effective April 1, 2023, and until his or her successor is each duly elected andor qualified, or until his or her earlier death, resignation, or removal. Ms. Raney and Mr. Bali have consented, if elected as Class I Directors of the Company, to serve until their respective terms expire. The Board believes that Ms. Raney and Mr. Bali will serve if elected, but if a nominee should become unavailable to serve as a director, and if the Board designates a substitute nominee, the person or persons named as proxy in the enclosed form of proxy may vote for a substitute nominee recommended by the Nom Gov Committee and approved by the Board.

Information Concerning the Director Nominees

Upon the recommendation of the Nom Gov Committee of the Board, the Board has nominated Linster W. Fox, Maureen T. Mullarkey, and Secil Tabli Watson, current Class III Directors of the Company, for election as Class III Directors of the Company. Ms. Watson was selected from a group of candidates identified and interviewed by members of the Nom Gov Committee and then presented to, interviewed by, and ultimately selected for membership, by the full Board. If elected, each will serve a three-year term until the Company’s 2026 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified or until his or her earlier resignation or removal. Mr. Fox and Mses. Mullarkey and Watson have consented, if elected as Class III Directors of the Company, to serve until their respective terms expire. The Board believes that Mr. Fox and Mses. Mullarkey and Watson will serve if elected, but if a nominee should become unavailable to serve as a director, and if the Board designates a substitute nominee, the person or persons named as proxy in the enclosed form of proxy may vote for a substitute nominee recommended by the Nom Gov Committee and approved by the Board.

Information regarding the business experience of our nominees for election as Class IIII Directors is provided below, as well as a description of the skills and qualifications that are desirable in light of our business and structure and led to the conclusion that each nominee should serve as a director.

| | |

Class I Directors Whose Term Will Expire in 2021 |

|

Eileen F. Raney INDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERT

Age: 71

Director Since: 2016

Committees: Audit, Compensation, Nom Gov (Chair)

|

BACKGROUND |

•Served from January 2011 to November 2013 as a member of the Board and a member of the Audit, Compensation, and Governance Committees of the Board of SHFL entertainment, Inc., a global gaming supplier that was acquired by Bally Technologies, Inc. in November 2013

|

•Founder and Sole Proprietor of Carpe Executive Coaching, a company which provides advisory services to improve executive leadership and performance since 2020

|

•Certified as an Executive Coach by the Center for Executive Coaching in 2020

|

•Certified as a National Association of Corporate Directors (NACD) Board Leadership Fellow in 2018 to 2020

|

•Active member of the Advisory Board for the University of Nevada-Las Vegas Libraries since 2010

|

•Active member of the Advisory Board of Fino Consulting since June 2015

|

•Served on the Board of the University Medical Center of Southern Nevada from 2014 to 2017, as Vice Chair of the Board of Governors and as Chair of both the Strategy Committee and the Audit and Finance Committee

|

•Served from April 2013 to April 2015 as a member of the Board and Finance Committee of the Board of Nevada Health Centers, a federally-qualified health center in Nevada

|

•Retired as National Managing Principal, Research & Development and Member, Deloitte & Touche USA Executive Committee in 2007, a position Ms. Raney held from 2003 to 2007

|

•Served on the Deloitte Board of Directors from 2000 to 2003 while serving as the Human Capital E-Business Leader

|

•Held numerous positions with Deloitte & Touche USA, LLP from 1988 to 2007, including Global Leader, Integrated Health Group from 1996 to 2000, and Western Regional Leader and National Co-Leader, Integrated Health Group from 1988 to 1996

|

DIRECTOR QUALIFICATIONS |

Ms. Raney provides valuable knowledge and skills to our Board due to her financial skills and experience in the gaming industry. Ms. Raney has been designated as an “audit committee financial expert” in accordance with NYSE listing standards. |

| | |

Atul Bali INDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERT

Age: 49

Director Since: 2019

Committees: Audit, Compensation, Nom Gov

|

BACKGROUND |

•Serves, since 2016, as non-executive Chairman of the Board of Meridian Tech Holdings Ltd., a regulated global emerging markets sports betting and online gaming firm, operating in Europe, Latin America, and Africa

|

•Serves, since 2021, as non-executive Chairman of The Football Pools Limited, the oldest pool betting company in the world, based in the United Kingdom

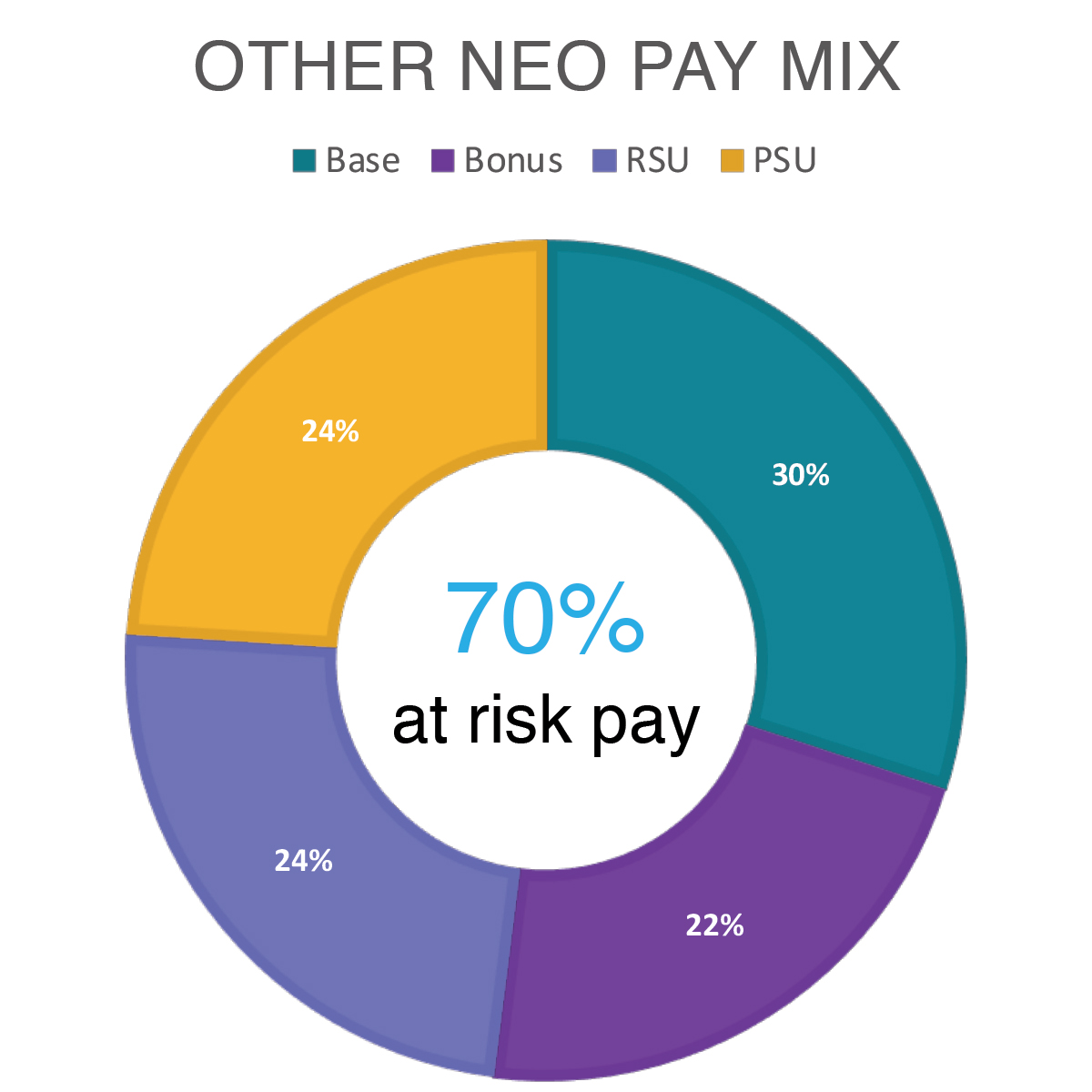

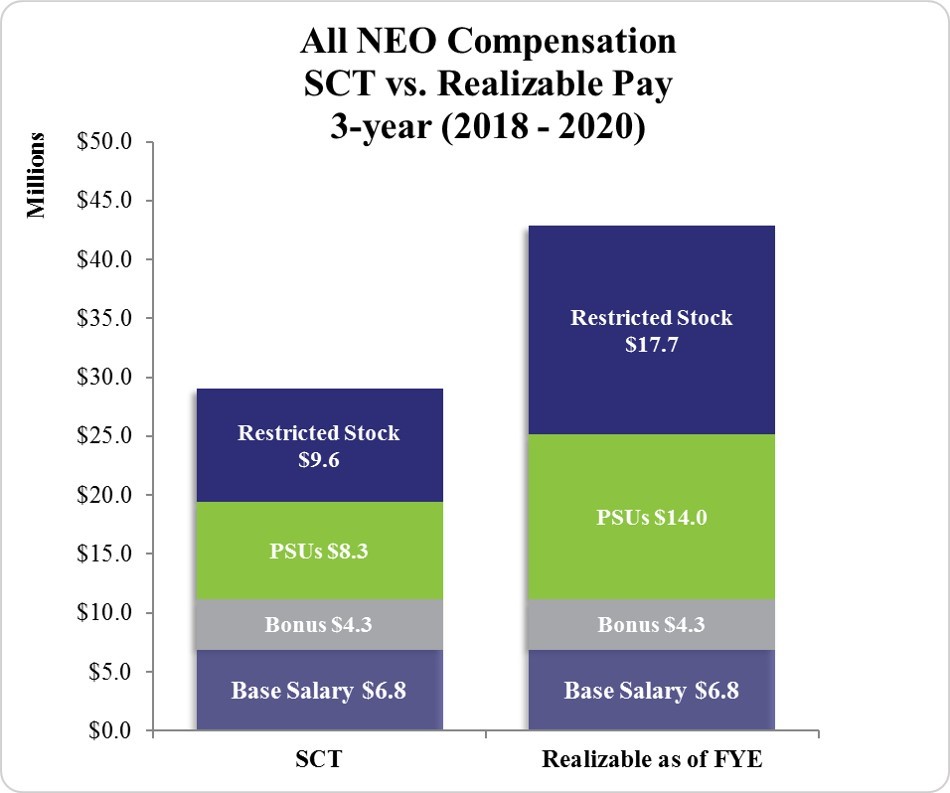

|